Divorce and Bankruptcy

According to a 2018 study by Ramsey Solutions, money issues are the top cause of arguments among spouses. Unfortunately, financial stress is also a leading cause of divorce (right after infidelity).

But if you’re planning to file for both divorce and bankruptcy, it’s important to do so in the right order. That’s why we’ve gathered a list of 6 things you should know about divorce and bankruptcy.

How each type of bankruptcy affects divorce proceedings

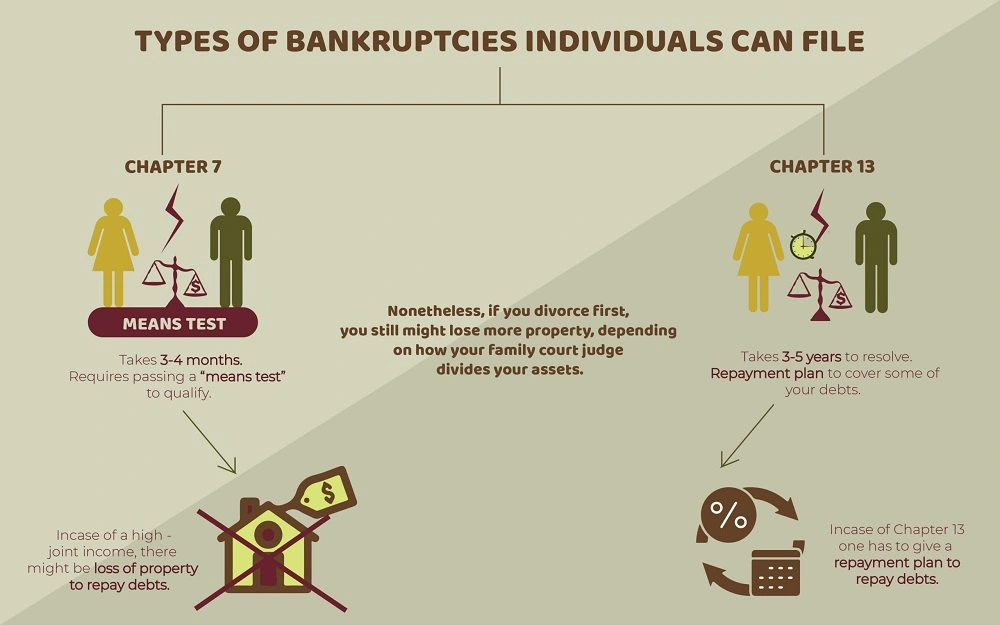

Individuals can file for two types of bankruptcy: Chapter 7 and Chapter 13.

Chapter 7 bankruptcy, or liquidation bankruptcy, usually takes 3-4 months and requires passing a “means test” to qualify, which means your income must be below a certain level. You may choose Chapter 7 bankruptcy first because the proceedings go fairly quickly, and you can discharge joint debts before you divorce. That means you would no longer be legally responsible for those debts.

However, because you need to pass a means test, you may not qualify for Chapter 7 if your joint income is too high. You also will likely lose some property that you own that may be sold to repay debts.

In contrast, Chapter 13 bankruptcy takes 3-5 years to resolve, since you enter a repayment plan to cover some of your debts. Filing for Chapter 13 before divorcing can complicate matters by entangling your financial life with your spouse for longer.

That said, if you divorce first, you still might lose more property, depending on how your family court judge divides your assets.

How divorce and bankruptcy courts handle property

Bankruptcy courts decide what property is exempt, or in other words, what you own that you can keep after bankruptcy. Many states let you double the amount of exempt property if you file a joint bankruptcy with your spouse. Being able to keep more of your property might encourage some couples to delay divorce until after bankruptcy.

Plus, filing for bankruptcy first gives you the advantage of the “automatic stay.” If you want to freeze your assets and debts until the bankruptcy ends – and hold off dividing them until later – this legal maneuver may work in your favor.

That said, you may not qualify for increased exemptions. And if you’re not worried about paying your ex-spouse’s debts, filing for bankruptcy after divorce may let you save the exemptions for your own personal property.

How divorce and bankruptcy courts handle debt

Filing lawsuits over debts during divorce can be costly and time-consuming. No one wants to be on the hook for their ex-spouse’s bad spending habits, even for joint debts!

But debts are more likely to get messy if a couple divorces and then only one ex-spouse files for bankruptcy. The bankrupt spouse gets their portion of a joint debt discharged (effectively removed), but creditors can legally go after the non-bankrupt spouse for the full debt.

Because creditors aren’t part of your divorce. That means bankruptcy proceedings override a divorce court’s orders. And while the non-bankrupt spouse can sue the other to recover part of the paid debt, that means going back to court.

In these situations, it may be better to declare bankruptcy before divorce. This ensures that you can’t be held liable for any debts discharged later.

The pros and cons of declaring bankruptcy first

Filing for bankruptcy before divorce carries several benefits, such as:

- Sharing legal fees

- Simplifying property division during your divorce case

- Discharging joint debts

- Eliminating unwanted contracts like car loans or underwater mortgages where you owe more than the house is worth

And, as we noted above, filing for bankruptcy first means that spouses aren’t on the hook for paying joint debts later. Additionally, the automatic stay can keep your creditors out of your hair.

But you should also consider the downsides of declaring bankruptcy first, such as:

- Not qualifying for Chapter 7 due to a high income

- Navigating a 3- to 5-year repayment plan with an ex-spouse

- Losing any joint assets to your creditors

The pros and cons of getting a divorce first

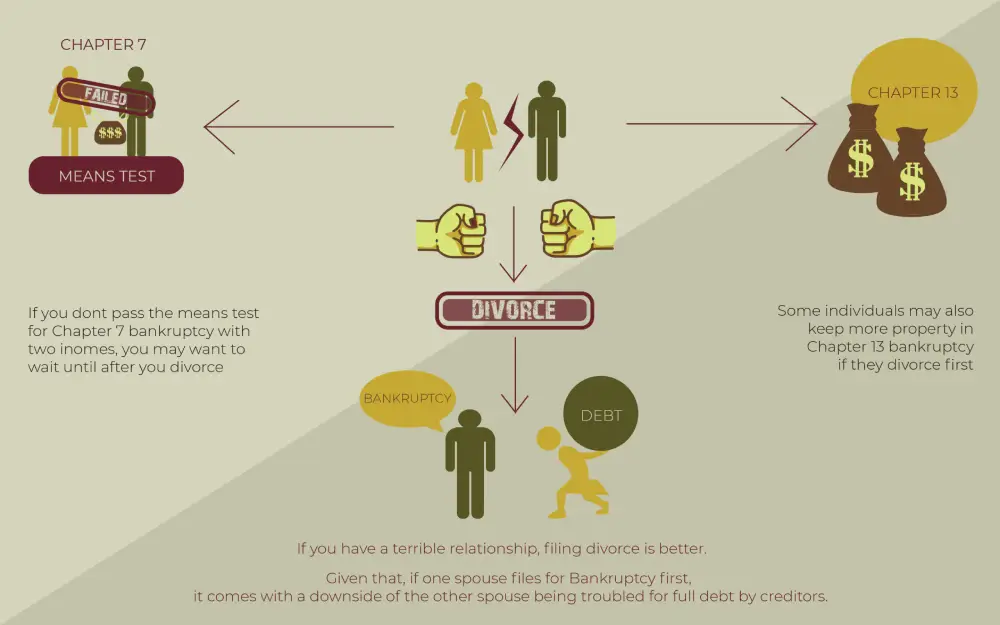

In some cases, you may find it better to file for divorce first.

For instance, if you don’t pass the means test for Chapter 7 bankruptcy with two incomes, you may want to wait until after you divorce. Some individuals may also keep more property in a Chapter 13 bankruptcy if they divorce first.

Additionally, if you have a terrible relationship with your spouse, divorcing first removes you from a tough situation.

That said, filing for divorce first also comes with potential downsides if only one spouse files for bankruptcy later. This is especially if one spouse gets joint debt discharged, but creditors can come after the other for the full debt.

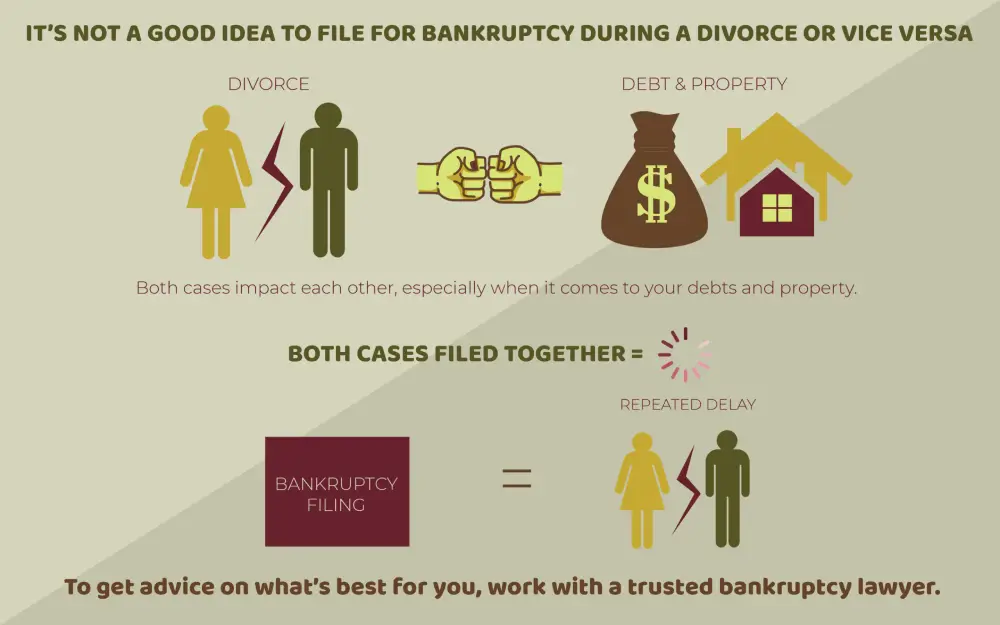

Why you shouldn’t file for both at the same time

It’s not a good idea to file for bankruptcy during a divorce or vice versa. Both cases impact each other, especially when it comes to your debts and property.

Trying to file for both means that your cases will likely be delayed, sometimes repeatedly. You can’t finalize a divorce if you’re filing for bankruptcy.

Which comes first: divorce or bankruptcy?

Whether you file for divorce or bankruptcy first depends on you and your situation. Most couples shouldn’t file for both together, as complications can arise.

To get advice on what’s best for you, work with a trusted bankruptcy lawyer.

Connect with Us