Chapter 7 Bankruptcy Lawyer in Jackson, Mississippi

There are a number of reasons you or your family may choose to declare bankruptcy. At the Mississippi law firm of The Rollins Law Firm, we understand and take into consideration all of your reasons for choosing to pursue bankruptcy. A personal injury, job loss or even the rising cost of living can make it difficult for a person or family to cope financially.

If you have found yourself facing difficult financial times and feel as if you may be at the end of your rope, our experienced bankruptcy lawyers are here for you. Jackson bankruptcy attorneys Thomas C. Rollins Jr. and Jennifer Curry are committed to helping you get back on your feet and back to a stable financial state.

When you visit The Rollins Law Firm, you will be greeted with a warm welcome from our devoted staff. Our goal is to make you feel comfortable and listened to during this stressful time in your life. During your consultation with our bankruptcy lawyer, you can count on being heard and embraced with warm communication and straightforward advice. During your initial consultation, a seasoned bankruptcy expert from Mississippi will examine your financial situation and help determine which type of bankruptcy is right for you.

Chapter 7 Payment Plans Available!

The Rollins Law Firm can help eliminate your debt at affordable fees. When you choose to retain our firm and file for Chapter 7 bankruptcy, you can select from our available payment plan options. We don’t cut corners like the bankruptcy mills. We are the only firm offering payment plans for Chapter 7.

Want to get your case filed quickly? You can choose to pay less up front and pay the remaining fees over time.

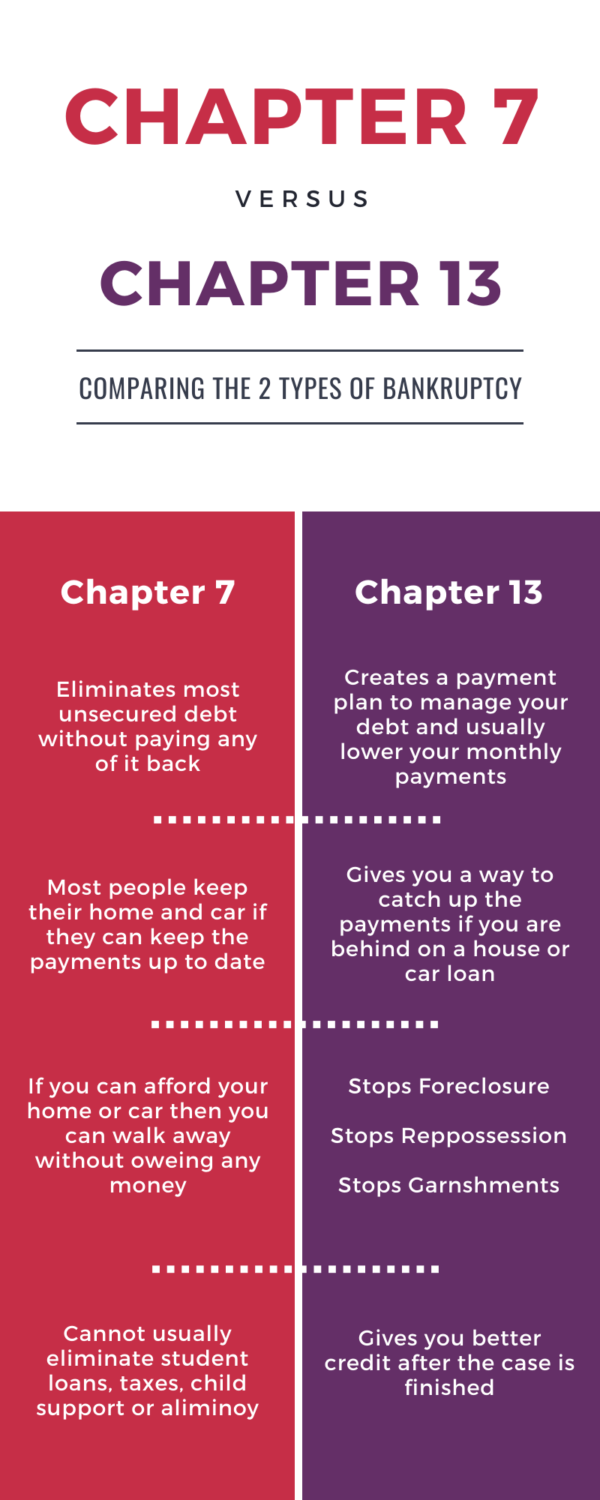

Chapter 7 vs Chapter 13 Bankruptcy

| Chapter 7 | Chapter 13 |

|---|---|

| Eliminates most unsecured debt without paying any of it back | Creates a payment plan to manage your debt and usually lower your monthly payments |

| Most people keep their home and car if they can keep the payments up to date | Gives you a way to catch up the payments if you are behind on a house or car loan |

| If you can afford your home or car then you can walk away without owing any money | Stops Foreclosure

Stops Repossession Stops Garnishments |

| Cannot usually eliminate student loans, taxes, child support or alimony | Gives you better credit after the case is finished |

Chapter 7 Bankruptcy Eligibility in Jackson, MS

Chapter 7 allows for any unsecured debts, such as credit card and medical bills, to be discharged at the end of the bankruptcy process. However, before you can declare bankruptcy, you will have to pass the bankruptcy means test to see if you qualify for Chapter 7. There is a certain level of income above which you will not qualify for Chapter 7 but may qualify for Chapter 13. Debtors with primarily business debts always qualify for Chapter 7. Our Jackson bankruptcy attorneys can help you determine whether you’re eligible for a Chapter 7 bankruptcy filing.

Discharged Debts in Mississippi Chapter 7 Bankruptcy Cases

A Chapter 7 bankruptcy gives you the opportunity to make a fresh start. It will eliminate unsecured debt, including credit cards and medical bills. Like in a Chapter 13 filing, our Jackson bankruptcy attorneys will stop creditor harassment, wage garnishment and most other lawsuits collections or otherwise. Unlike Chapter 13, there is no limitation on the amount of debt a filer may have. Chapter 7 requires no repayment plan and you are no longer responsible for the debt after it is discharged. Also, the discharge of debt is fairly quick.

Assets & Property in Chapter 7 Bankruptcy Filings

By filing Chapter 7 in Mississippi, you will be able to keep your future income and some property you acquire after filing. Most people can keep the majority of their property in a Chapter 7 filing because of the property exemptions. However, some of this property may be liquidated, or sold, if you are unable to pay down your secured debts. Examples of secured debt include home and car loans. You have the option of surrendering this property to your creditor or paying the current and past due balance on your loans to retain it. Our Jackson bankruptcy lawyers will explain to you your options regarding your property after filing and the time periods that are crucial to the property you own prior to filing and after filing for Chapter 7 Bankruptcy.

With our Jackson attorneys, you are never alone.

Our Jackson Chapter 7 bankruptcy lawyer from the Rollins Law Firm is committed to providing you with quality bankruptcy service. From the moment you walk into our Jackson MS office, you can rest assured that your needs will be met. We are by your side throughout the bankruptcy process, from filing paperwork to negotiating with creditors.

By filing Chapter 7 bankruptcy you can eliminate almost all of your unsecured debts. And you get to keep your home and car!

Hiring an expert bankruptcy lawyer from Jackson, MS can help you deal with your difficult times with the best advice.

Know all about the filing process, required documents, exemptions, reaffirmation agreements, and more!

What is Chapter 7 Bankruptcy & How Does Filing Work?

Chapter 7 bankruptcy is a legal process that people use to eliminate debt. However, not all debts are eliminated.

Unsecured & Secured Debts

The most common type of debt that people can get rid of in bankruptcy is unsecured debts. Unsecured debts are debts that do not have collateral, such as medical debts, credit cards, and payday loans.

There are certain types of unsecured debts that cannot be wiped out in bankruptcy – such as child support, alimony, taxes, student loans and a few others that are less common.

Secured debts, on the other hand, are a little more complicated. Secured debts are defined as any debt that is secured by a property – usually with a lien. Common examples are home mortgages and auto loans.

Now it is possible to eliminate secured loans as well in chapter 7. But you would have to surrender or return the collateral to do so.

Will You Get to Keep Your Property?

Most people get to keep all of their property when they file chapter 7 except in a few cases where the property can be seized.

You can also keep your house and/or car, but you’ll need to keep making the monthly payments to do so. (More on that later in our “Reaffirmation Agreements” section)

In fact, chapter 7 is nicknamed liquidation bankruptcy for the same reason. The term liquidation means to convert an asset to cash. This is usually done by seizing the property and then selling or auctioning it.

When you file a chapter 7 case, a trustee is appointed. This trustee’s main task is to determine if there are any assets in the case that are eligible to be liquidated.

Exemptions

However, there are also certain exemptions in Chapter 7. Exemptions determine which property a person can keep when he files for bankruptcy. Exemptions are a part of state law and therefore vary depending on where you live. In Mississippi, a person can keep their home if they have less than $75,000 in equity.

Most people can also keep their cars as long as they don’t have too much equity. There is a $10,000 personal property exemption that includes vehicles. Additionally, if a married couple files the bankruptcy together, the exemption is doubled to $20,000.

Here’s a detailed article on bankruptcy exemptions in Mississippi. Our bankruptcy lawyers in Jackson, MS can give you expert advice on the provisions of Chapter 7 bankruptcy!

Now, once you file a bankruptcy case, something called the Automatic Stay goes into effect.

What is the Automatic Stay?

The Automatic Stay is basically a rule that states that all the collection activity must stop as soon as a bankruptcy case is filed.

Once the creditors are notified that you’ve filed bankruptcy, they can no longer call, write letters or take any action to collect the debt. From that point on they must only communicate through your bankruptcy lawyer or by filing documents with the bankruptcy court.

The automatic stay stops wage garnishments, bank garnishments, repossessions and foreclosure sales. Once you file the case, the lawyer will contact the creditors to stop foreclosure and repossessions.

For example, if your car was repossessed prior to the bankruptcy filing, your lawyer can probably have it returned under Mississippi law as long as you file the bankruptcy case within 10 days of the repossession.

What Documents Does Your Bankruptcy Lawyer Need to Prepare a Case?

Your bankruptcy will need some documents from you in order to prepare your case.

Many attorneys will pull a credit report to get a list of debts you owe. You will need to review this list carefully and let the lawyer know if any debts are missing. Many local lenders and medical providers do not report to credit bureaus. If you leave any debt off, it can cause problems for you later.

Our Mississippi bankruptcy lawyer will also need your bank statements for the last few months. Again, you must review these before filing to look for any large or suspicious transactions. After you file your case, the bank statements will be turned over to your trustee, who will review them carefully.

Apart from this, you will also need to provide 6 months of paycheck stubs for every person that contributes income to your household.

For married couples, this usually means that the lawyer will need your spouse’s pay stubs too, even if they are not filing a bankruptcy case. And if the spouse is not willing to provide them to you, we may have to work off of an estimate.

Next, our Jackson bankruptcy lawyer will need to review the last two tax returns that you have filed.

Lastly, most bankruptcy lawyers have their questionnaire about your finances. You will need to answer those as well.

What is Credit Counselling & Why Do You Have to Do It?

Bankruptcy laws require debtors to complete a credit counselling course prior to filing bankruptcy. After filing, another course must be completed before receiving a discharge. As such, you must complete two courses to get a bankruptcy discharge.

Our Jackson bankruptcy attorneys usually direct our clients to an online course. But if you cannot do the course online, we also have a phone option for you! Our experienced bankruptcy lawyer based in Jackson, MS can guide you with the course.

What Happens When You Meet the Bankruptcy Lawyer to File the Case?

Once our Jackson bankruptcy attorney has prepared your bankruptcy case, you must review the paperwork and sign it before you file it with the bankruptcy court. These are a few of the documents you will need to review:

- Bankruptcy Petition – Filing this document opens a new bankruptcy case. It contains basic information like your name, address, business names, if applicable, the chapter you are filing, prior cases and some statistical questions about how much debt you have.

- Schedule A/B – This is a list of all the property you own. The property, in this case, is not limited to real estate. The property also includes the shirt you are wearing right now! Your phone. Your dog. Your couch. Everything you own must be listed on this form!

- Schedule C – This is a list of property that you claim as exempt, in that the property you want to keep. You must also include a reference to the law you claim allows you to exempt the property.

- Schedule D – This is a list of your creditors who have collateral.

- Schedule E/F – This is a list of your creditors who do not have collateral

- Schedule G – This is a list of outstanding leases and contracts that you still owe

- Schedule H – This is a list of all your co-signers

- Schedule I – This is a list of your monthly incomes

- Schedule J – This is a list of your monthly expenses

- Statement of Financial Affairs – This is a list of miscellaneous questions about your financial life including:

- If you are you married

- Your previous years’ incomes

- Your prior addresses

- Transfers of property in the last 2 years

- Gifts & charitable contributions

- Current or prior lawsuits, garnishments, repos

- Businesses you have owned

…and many more questions!

- Statement of intent – This is a list of your secured debts and allows you to declare if you want to surrender or keep paying for the collateral

- Means Test – This is a complex test that your bankruptcy lawyer will complete to determine if you qualify for chapter 7 bankruptcy

- Creditor Matrix – This is a list of all your debts and co-signers

If you’re looking for a skilled bankruptcy lawyer in Jackson, MS, contact us at The Rollins Law Firm for a free initial consultation!

Do You Have to Go to the Court?

Generally, in a bankruptcy case, the creditors meet in person. But since we’re in the middle of the COVID-19 pandemic, currently these hearings are being held over the telephone.

Before the pandemic, the courts used to hold the hearings in person. There are many places throughout the state where the courts hold these hearings, but common places include:

If you hire a bankruptcy lawyer, they will attend the 341 meetings of creditors with you. The trustee will be leading the meeting and will call all of the debtors, one at a time, to answer some simple questions, including:

- Did you sign the petition, schedules, statements, and related documents?

- Did you read the petition, schedules, statements and related documents before you signed them?

- Are you personally familiar with the information contained in the petition, schedules, statements and related documents?

- Is the information contained in the petition and all accompanying documents true? Are there any errors or omissions that you are aware of at this time?

- Have you identified all of your assets on the schedules? (assets include anything of value – accounts of all kinds, real property including any assets located out of the country, or personal property such as clothes, wedding rings, etc.).

- Have you listed all of your creditors on the schedules? (creditors are anyone to whom you owe money including your relatives)

- Have you previously filed for bankruptcy? (generally bankruptcies older than 8 years for Chapter 7 and less for Chapter 13 are fine, but they still need to be disclosed to the Bankruptcy Court and Trustee)

- Is the copy of the tax return, provided to the creditor before the meeting, a true copy of the most recent tax return that you have filed? (if you have filed a more recent tax return, be sure to give a copy to your attorney a week prior to the meeting, or bring a copy to the meeting if it is even more recent than that).

- Do you have any domestic support obligations such as child support or alimony that you might owe? If you do, you will be asked if you are currently on your post-petition domestic support obligations.

- Have you filed all the required tax returns for the past four years? (If you are not required to file, you will inform the trustee the same)

- Did you review the bankruptcy information sheet? (this sheet is provided when you hire us as your bankruptcy lawyer. It explains various types of bankruptcies)

- Have you made any transfers (giving or selling) to anyone in the past two years?

- Do you have a claim against anyone else such as a slip & fall, car accident, someone owing you money etc.?

The purpose of the meeting is for the trustee to verify your identity and determine if there are any assets that can be liquidated. The trustee will review your bank statements, tax returns and bankruptcy papers prior to the meeting. Their aim is to verify if you qualify for chapter 7 bankruptcy.

Additionally, you will need to bring your drivers’ license and social security card so that the trustee can inspect them. If your meeting is over the phone, then your bankruptcy lawyer will inspect your ID and vouch for your identity on the call.

What are the Reaffirmation Agreements?

Reaffirmation agreements are like contracts. You sign this agreement in a bankruptcy case to keep paying the debt.

For example, if you like your car and are up to date on the payments you would probably prefer to keep your car and keep making the payments. In order to do so, you must sign a reaffirmation agreement which legally binds you to keep paying for the car.

But what if you sign a reaffirmation agreement and then default on the payments?

In that case, the creditor is entitled to contact you and even sue you for the balance owed. If you sign a reaffirmation agreement you have 60 days to change your mind and rescind it.

What Debts Will You Still Owe After the Bankruptcy Case is Over?

There are many types of debts that cannot be eliminated in bankruptcy. Here are the most common:

- Taxes – most taxes are not dischargeable, but they may be if they are over 3 years old and you had filed your return on time

- Student Loans

- Child Support

- Alimony

- Debts incurred by fraud

- Intentional Torts – that is, if you’ve intentionally harmed someone

- Debts caused by DUI

- Debt that you incurred right before filing bankruptcy

Will You Get to Keep Your Tax Refund If You File For Chapter 7 Bankruptcy in Mississippi?

Most people that file chapter 7 in Mississippi get to keep their tax refunds. This is because tax refunds can usually be claimed as exempt under Mississippi Law.

How Often Can You File For Chapter 7 Bankruptcy?

If you’ve previously received a discharge in a chapter 7 case, then you must wait 8 years after the previous case was filed. If you’ve previously filed chapter 13 then you must wait 6 years after the previous filing date to file again.

T.C. Rollins is a Jackson, MS Bankruptcy Lawyer and has been practicing bankruptcy law for 11 years.

Connect with Us