Can I Keep My House and Car in Bankruptcy?

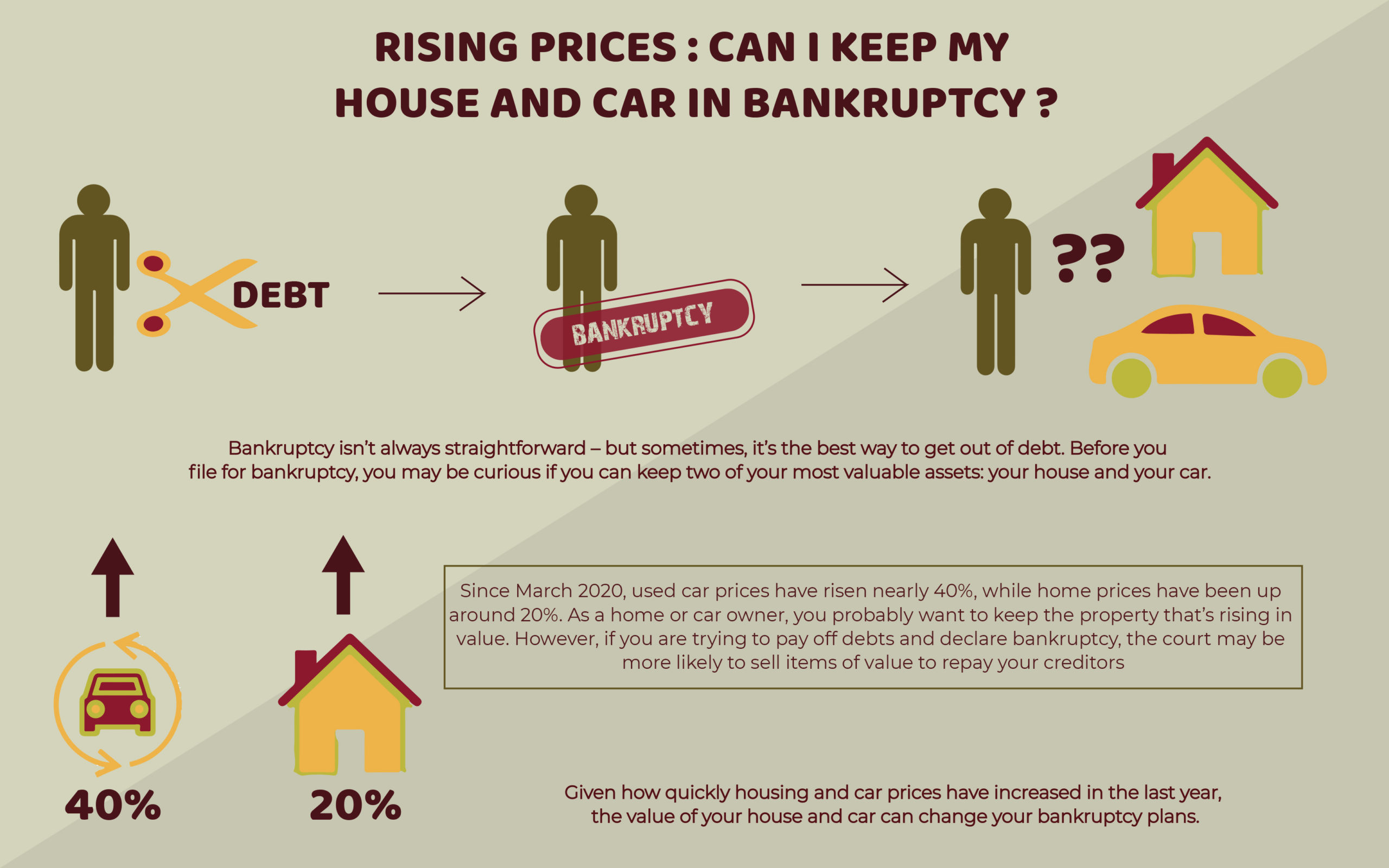

Bankruptcy isn’t always straightforward – but sometimes, it’s the best way to get out of debt. Before you file for bankruptcy, you may be curious if you can keep two of your most valuable assets: your house and your car.

Since March 2020, used car prices have risen nearly 40%, while home prices have been up around 20%. As a home or car owner, you probably want to keep the property that’s rising in value. However, if you are trying to pay off debts and declare bankruptcy, the court may be more likely to sell items of value to repay your creditors.

Given how quickly housing and car prices have increased in the last year, the value of your house and car can change your bankruptcy plans.

Chapter 7 vs Chapter 13

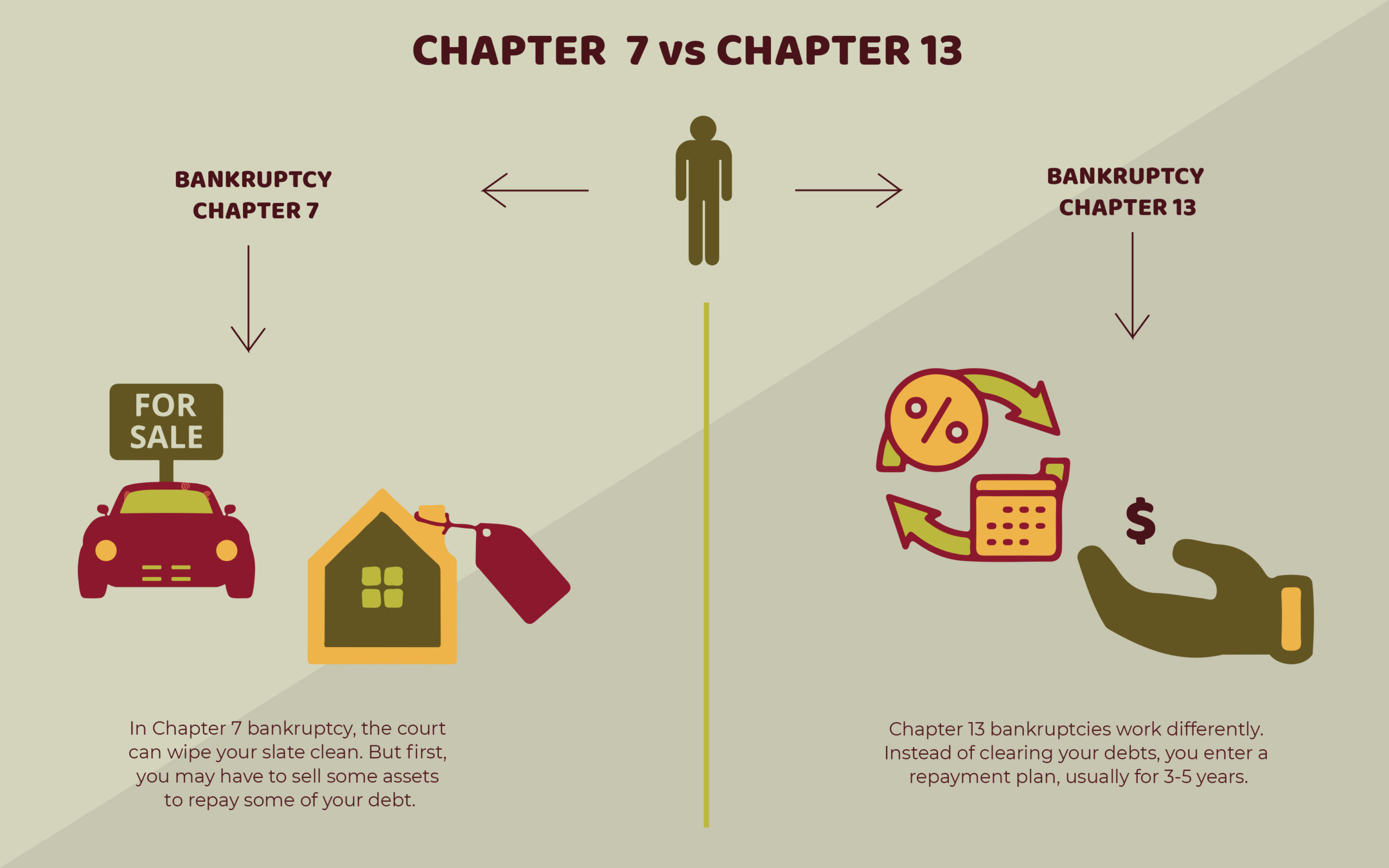

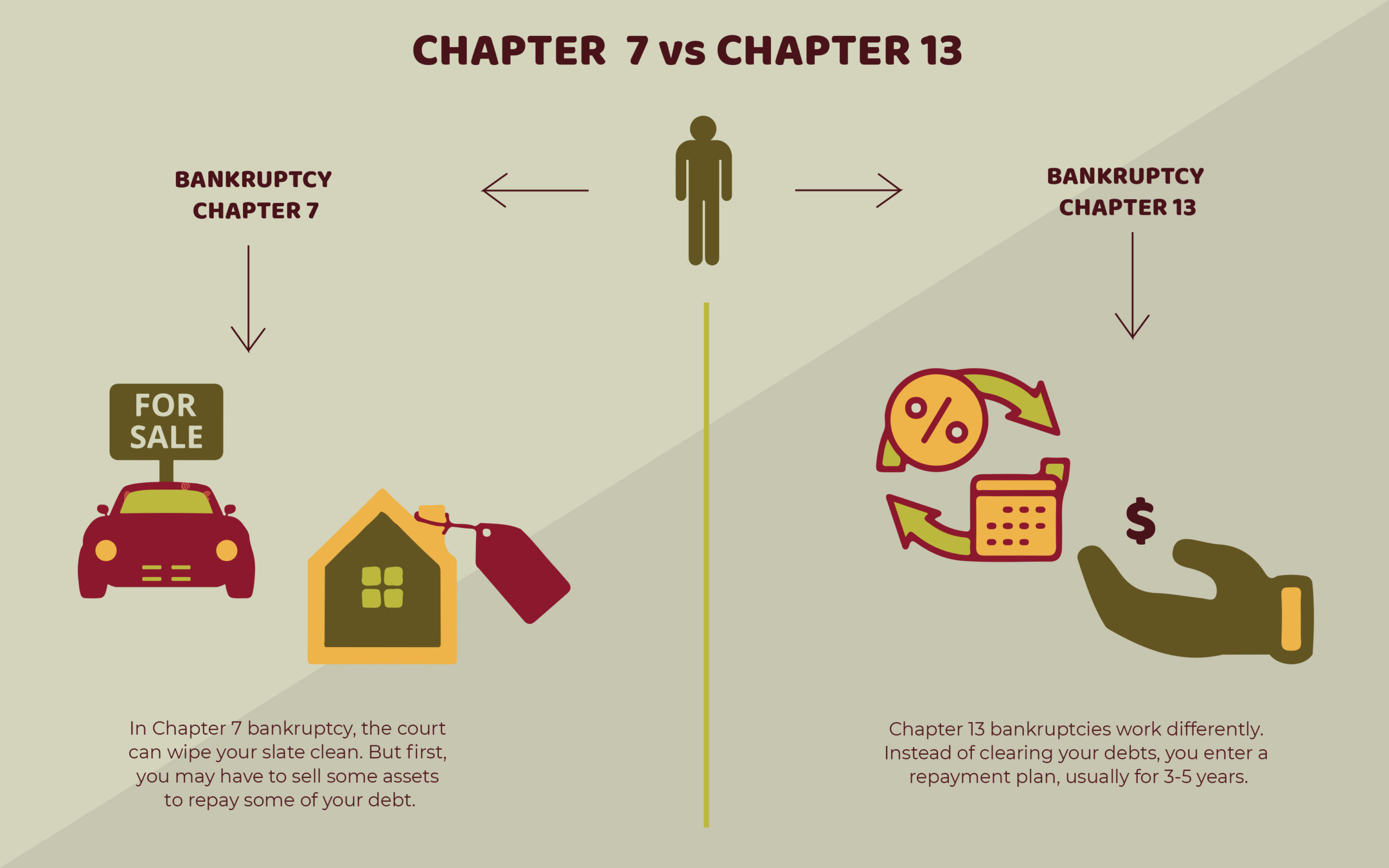

You can file two main types of bankruptcy: Chapter 7 and Chapter 13. Each filing will impact your assets (items of value) in different ways.

In Chapter 7 bankruptcy, the court can wipe your slate clean. But first, you may have to sell some assets to repay some of your debt.

Chapter 13 bankruptcies work differently. Instead of clearing your debts, you enter a repayment plan, usually for 3-5 years.

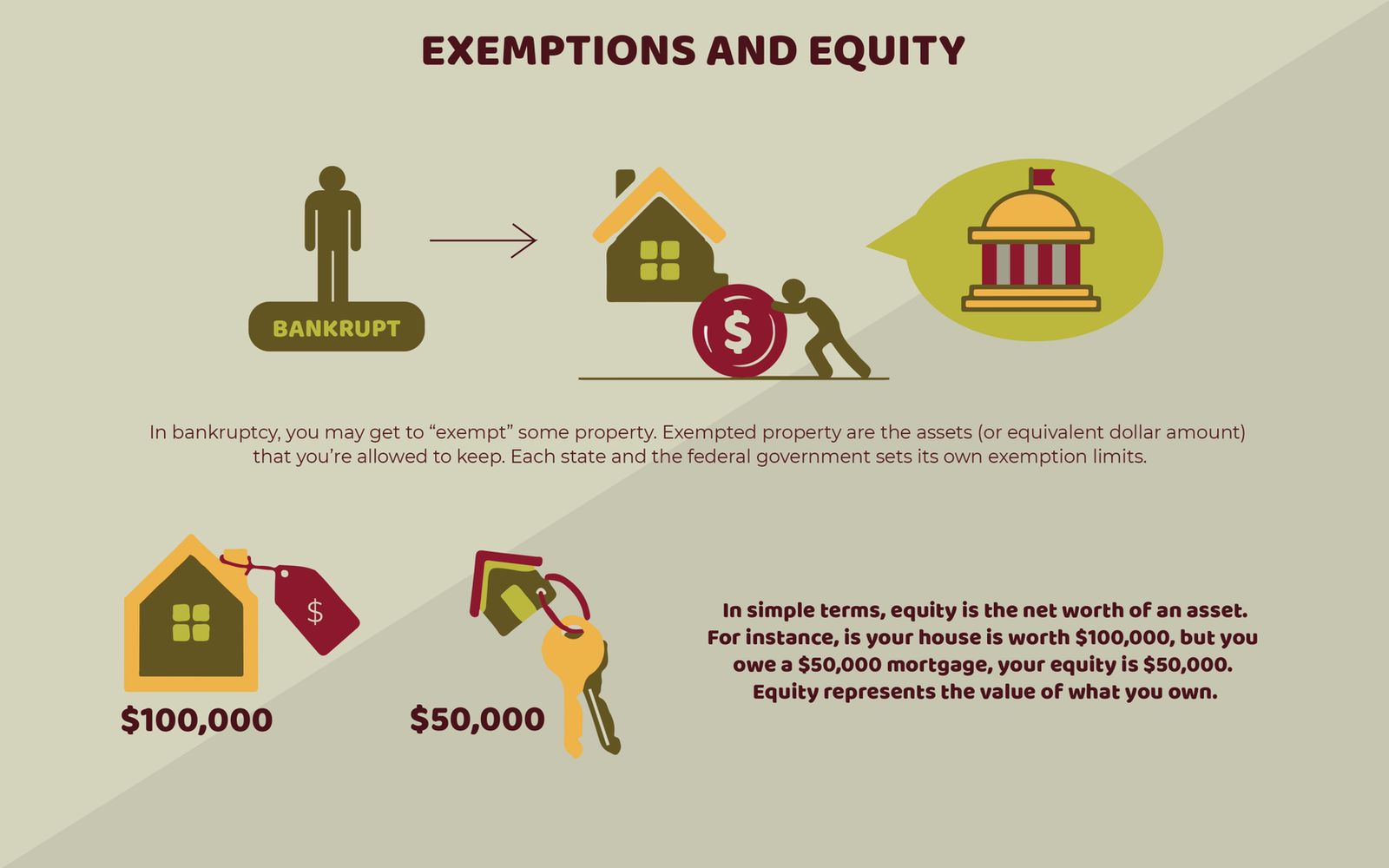

Exemptions and Equity

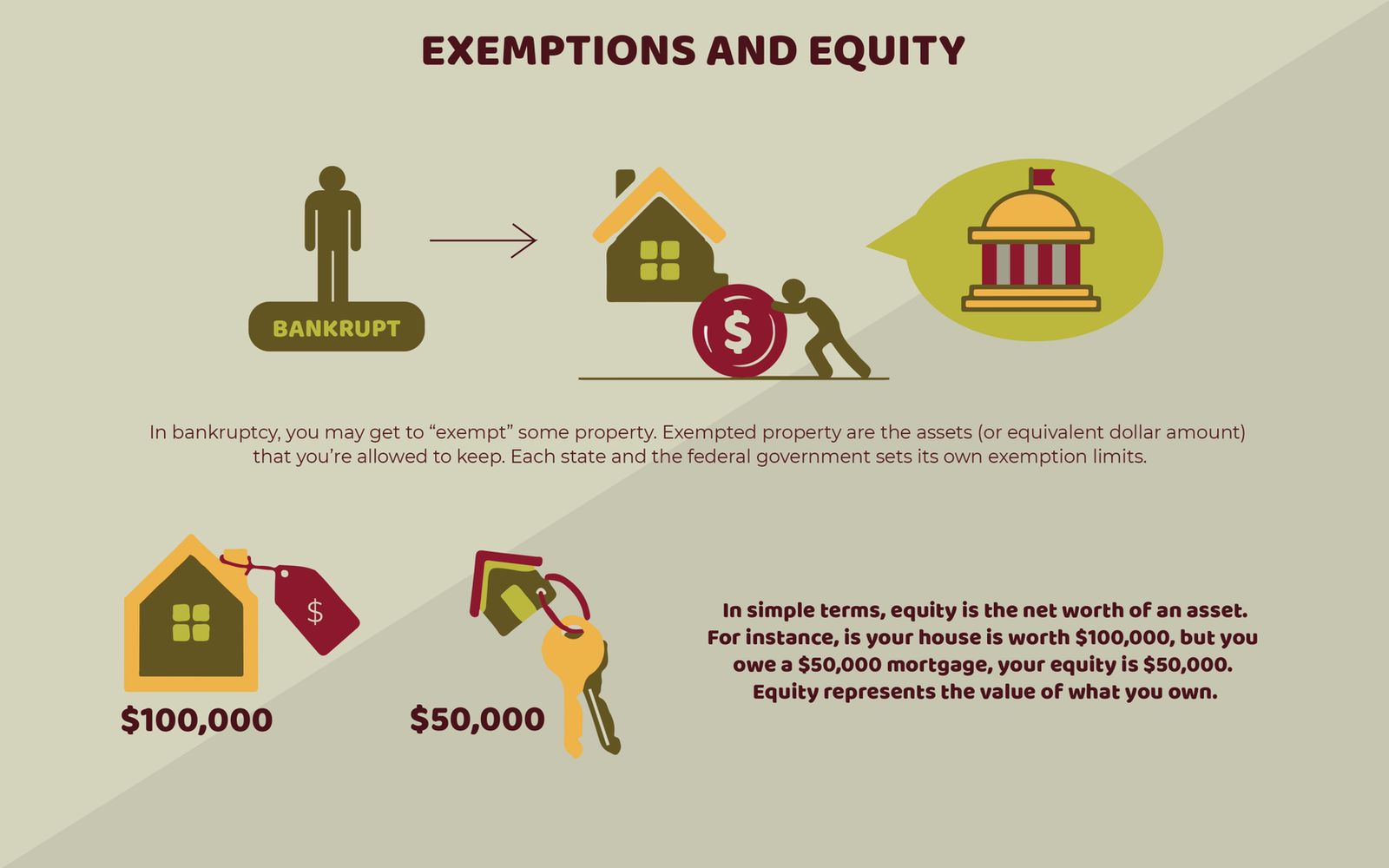

We’re going to touch on two points repeatedly: exemptions and equity.

In bankruptcy, you may get to “exempt” some property. Exempted property are the assets (or equivalent dollar amount) that you’re allowed to keep. Each state and the federal government sets its own exemption limits.

The other concept to know is equity. In simple terms, equity is the net worth of an asset. For instance, is your house is worth $100,000, but you owe a $50,000 mortgage, your equity is $50,000. Equity represents the value of what you own.

Now that we know the basics, let’s dive in.

Will I Keep My House in Bankruptcy?

Filing for bankruptcy doesn’t automatically mean you’ll lose your house. Both Chapter 7 and Chapter 13 bankruptcies have provisions to avoid this outcome, such as the “automatic stay” to temporarily stop foreclosure proceedings that would take the house away. But that doesn’t mean you’re guaranteed to keep your home.

The Homestead Exemption

Some states offer a “homestead exemption” to help you protect your equity. Essentially, this is a dollar value (or sometimes an acreage limit) for how much home equity you can protect. To claim this exemption, you generally must have lived in your home for at least 40 months.

Keeping Your House in Chapter 7

Whether you get to keep your house under Chapter 7 depends on your equity, mortgage, and state exemptions.

To start, if your state has a homestead exemption, you can protect some of your equity value right away. Then, the court will determine if there’s enough equity “leftover” to be worth selling your house. If you don’t – for instance, if you owe a hefty mortgage – you may get to keep your house.

However, the court probably won’t just “give” you your house. If you’ve defaulted on your mortgage, your lender has the right to foreclose and take away the house (unless you modify your loan).

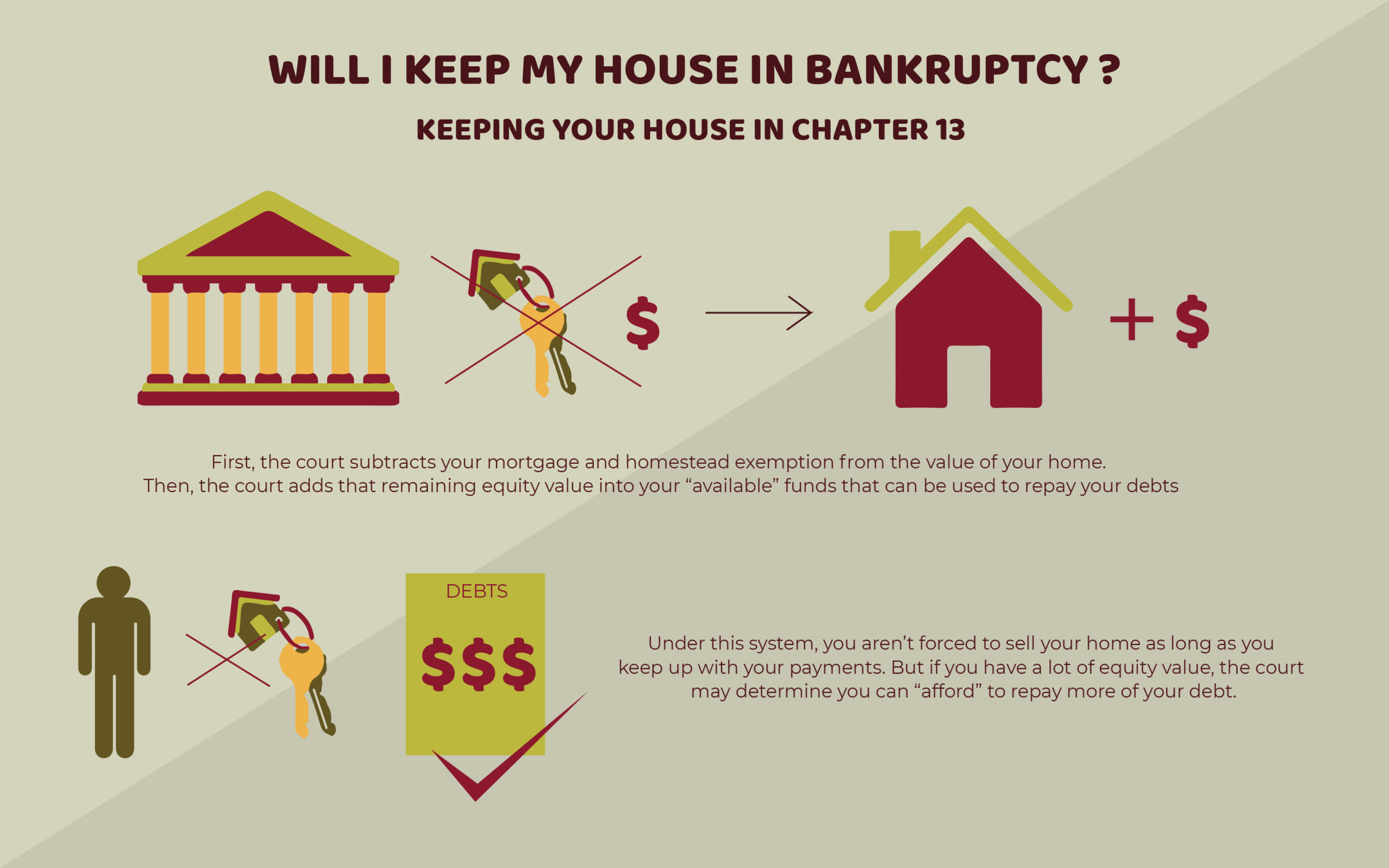

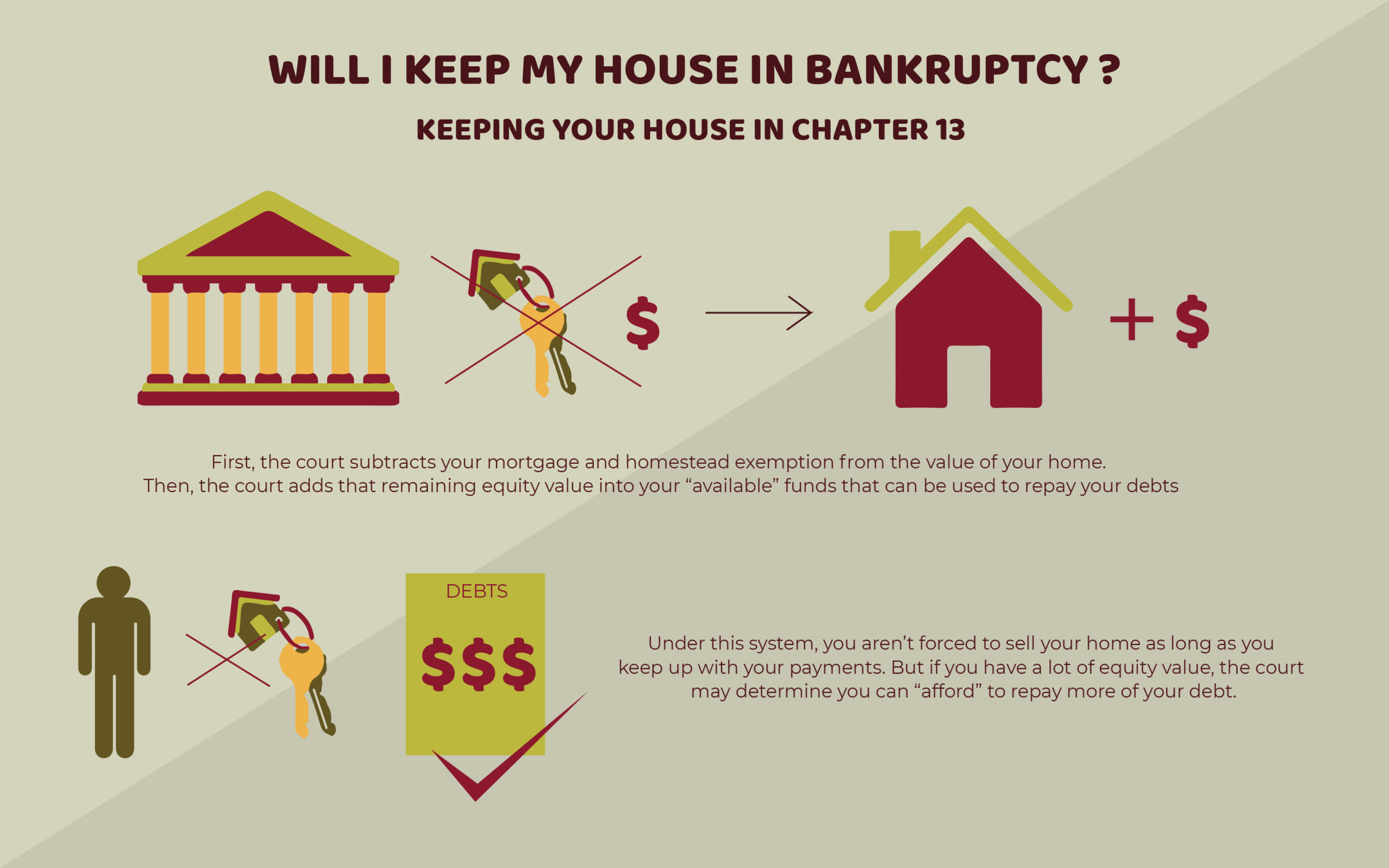

Keeping Your House in Chapter 13

Chapter 13 works a little differently. First, the court subtracts your mortgage and homestead exemption from the value of your home. Then, the court adds that remaining equity value into your “available” funds that can be used to repay your debts.

Under this system, you aren’t forced to sell your home as long as you keep up with your payments. But if you have a lot of equity value, the court may determine you can “afford” to repay more of your debt.

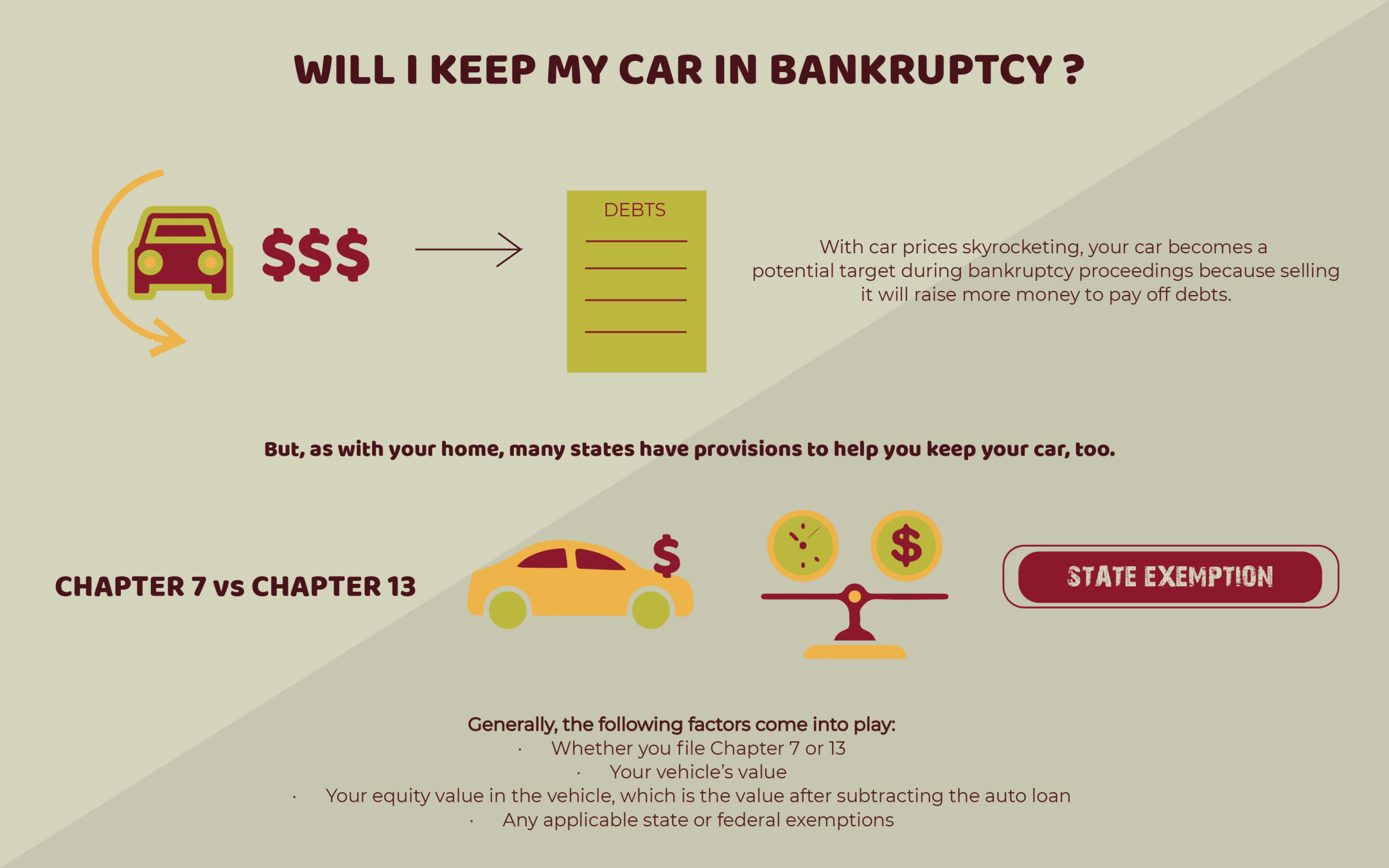

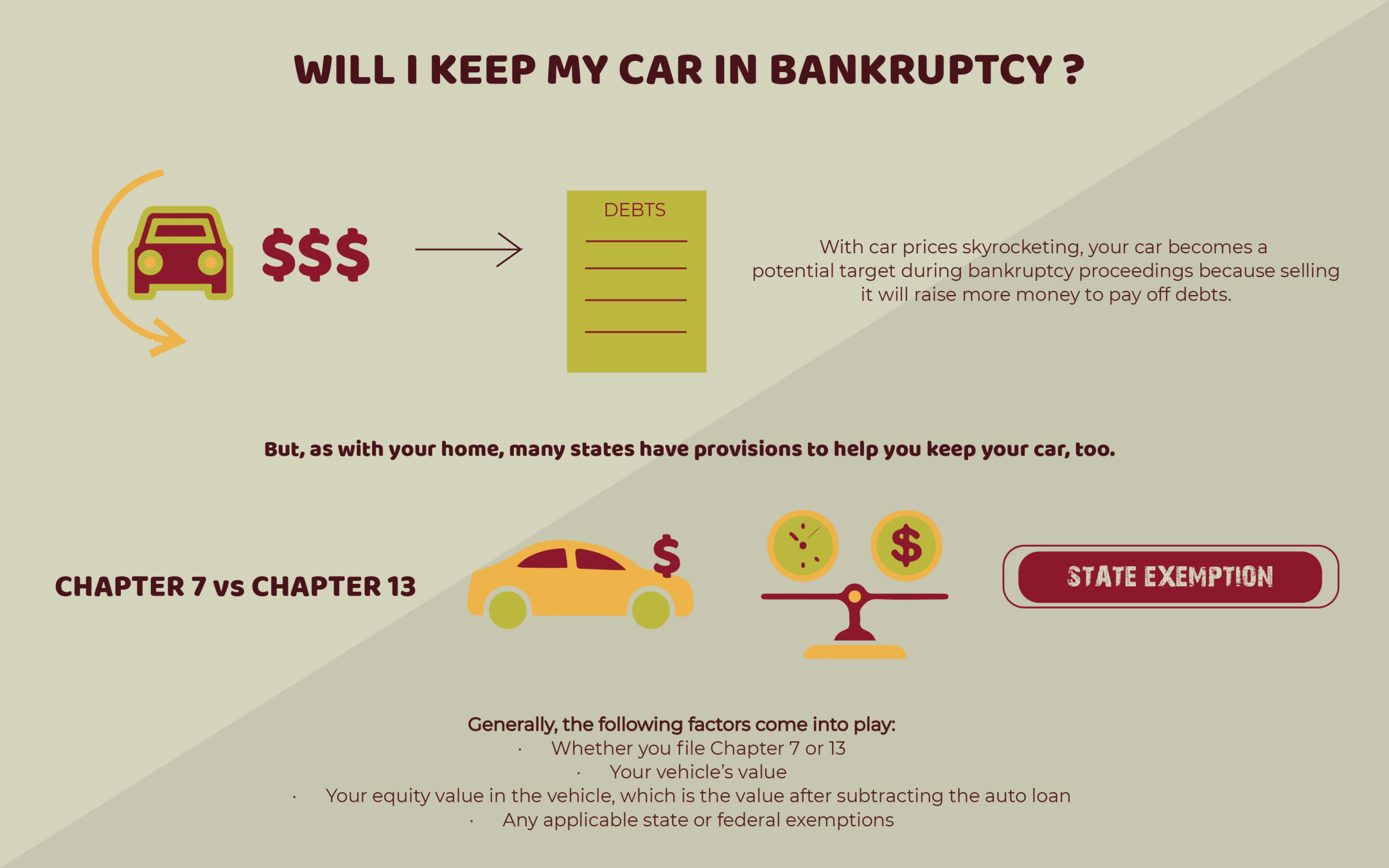

Will I Keep My Car in Bankruptcy?

With car prices skyrocketing, your car becomes a potential target during bankruptcy proceedings because selling it will raise more money to pay off debts. But, as with your home, many states have provisions to help you keep your car, too.

Generally, the following factors come into play:

- Whether you file Chapter 7 or 13

- Your vehicle’s value

- Your equity value in the vehicle, which is the value after subtracting the auto loan

- Any applicable state or federal exemptions

Bankruptcy is Complicated – Don’t Do it Alone!

Most states offer ways to help you keep your house and car (or at least some of their value) during bankruptcy. But exemptions and limits vary by state – as do other bankruptcy laws. Given the soaring prices of both homes and cars, you’ll need to carefully evaluate your options to save your home and car.

Instead of navigating bankruptcy by yourself, consider a bankruptcy attorney to help you keep as much of your property as possible!

Connect with Us