Jackson Bankruptcy Attorneys for Chapter 13

When you are faced with mountains of debt, every day can seem like a struggle. As fees and interest pile up, so do your worries. How will I afford to pay for gas and groceries this week? If the bank repossesses my car, how will I get to work? If a debt goes unpaid, the creditor can sue you for the money. They can get a judgment that will show up on your credit report if you can’t work something out. When everything seems to be falling apart, our Jackson bankruptcy lawyer works to help you piece your finances back together.

Our Jackson bankruptcy attorneys serve clients in Jackson and throughout Mississippi. To help you succeed in your Mississippi bankruptcy filing, we provide sensitive counsel and the legal resources you need. We don’t cut corners like some of the bankruptcy mills in town. Lack of preparation, such as incomplete bankruptcy forms, leads to disastrous consequences, which is our Jackson bankruptcy lawyer will first conduct a detailed bankruptcy case review before filing for bankruptcy at the Mississippi court.

Is your property being foreclosed? Is your car being repossessed? Or are your medical bills piling up? If you want to address your financial concern, our Jackson Mississippi bankruptcy attorneys can file your petition quickly. At our Mississippi law firm, our bankruptcy experts pull your credit report to speed up the process of gathering the necessary information. Once you provide all the necessary documents, our Chapter 7 & 13 bankruptcy lawyers will prepare your case quickly.

No attorney’s fees upfront for chapter 13.

We understand that those facing debt are already in a difficult situation. We don’t add to your burden. That’s why, when you retain our firm, you only need to pay the court fees upfront. Your attorney’s fees are paid overtime in your monthly bankruptcy payment. If you want to learn more about our affordable payment process, send us a message using the form below.

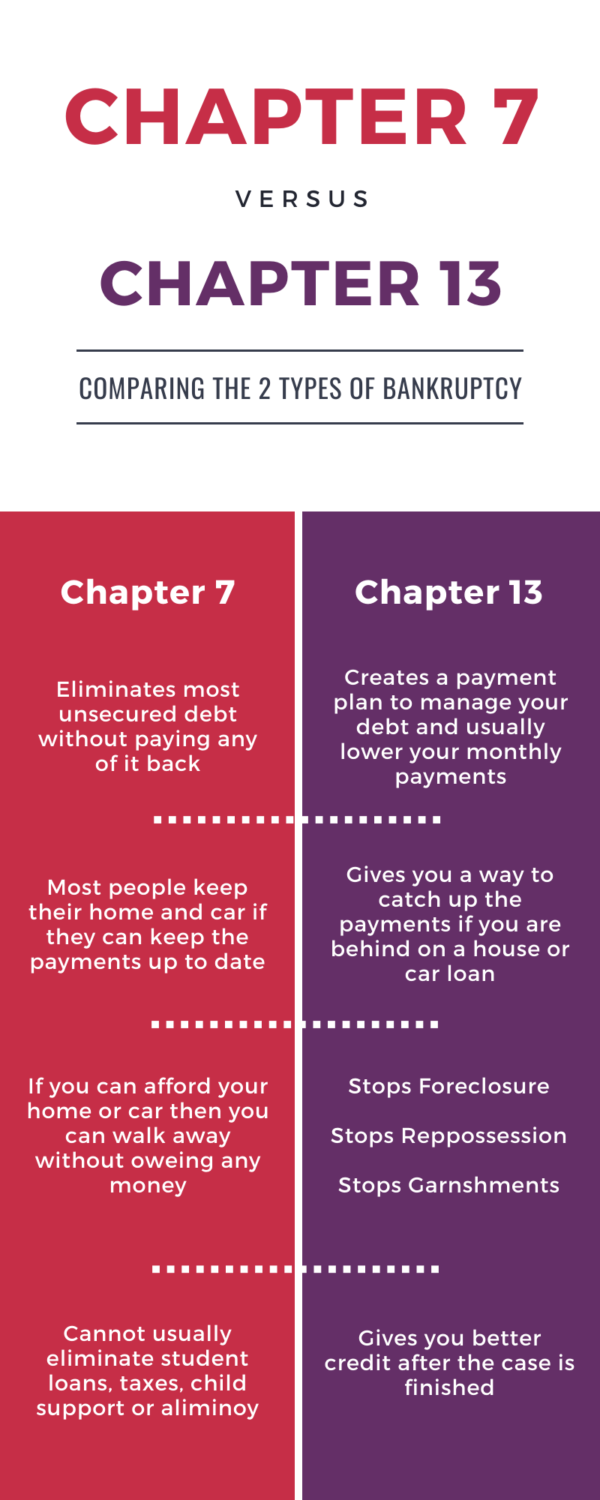

Chapter 7 vs Chapter 13 Bankruptcy

| Chapter 7 | Chapter 13 |

|---|---|

| Eliminates most unsecured debt without paying any of it back | Creates a payment plan to manage your debt and usually lower your monthly payments |

| Most people keep their home and car if they can keep the payments up to date | Gives you a way to catch up the payments if you are behind on a house or car loan |

| If you can afford your home or car then you can walk away without owing any money | Stops Foreclosure

Stops Repossession Stops Garnishments |

| Cannot usually eliminate student loans, taxes, child support or alimony | Gives you better credit after the case is finished |

Who is Eligible for Chapter 13?

Answers from a Jackson bankruptcy attorney

A Chapter 13 bankruptcy filing is only available to individuals that have a regular income because the debtor is required to make monthly payments for 3 or 5 years after filing. If a person has too much debt (roughly $900,000 secured or $300,000 unsecured), they may be disqualified from filing and will only be allowed to file Chapter 7 or 11.

If you’re considering bankruptcy Chapter 13, our Jackson bankruptcy attorneys can help you determine whether you’re eligible to file for bankruptcy.

What is the Chapter 13 Repayment Plan?

As explained by a Jackson bankruptcy lawyer

Chapter 13 Bankruptcy is especially beneficial to a person who is behind on their mortgage payment or has other secured debt because a Chapter 13 allows you to pay the arrears or back debt through the Chapter 13 “plan” and keep your home. The Chapter 13 plan is usually 3 or 5 years. It essentially consolidates the debt into a manageable monthly payment plan. The plan accounts for your living expenses first, and then the plan payment is determined by the amount of your leftover income.

How Can Bankruptcy Help Me Keep My Home?

Our Jackson Chapter 13 attorney explains

The biggest advantage of filing Chapter 13 is that the debtor usually gets to keep all of their property. Any amount that you are behind on mortgage payments can be paid through the Chapter 13 plan. Depending upon your individual circumstances however, a Chapter 7 bankruptcy may also be a suitable course of action.

At The Rollins Law Firm, we will work together with you to create a plan that could save your home. This might involve communicating with your lender to lower interest rates or arranging a payment restructure. No matter how complex your case, our Jackson bankruptcy lawyer is here to help. Contact our Mississippi bankruptcy attorney today!

With our Jackson attorneys, you are never alone.

Our Jackson Chapter 13 bankruptcy lawyer from the Rollins Law Firm is committed to providing you with quality bankruptcy service. From the moment you walk into our Jackson MS office, you can rest assured that your needs will be met. We are by your side throughout the bankruptcy process, from filing paperwork to negotiating with creditors.

How Does the Mississippi Chapter 13 Bankruptcy Work?

Chapter 13 is more popular in Mississippi than in most states. Chapter 7 is the most popular bankruptcy choice for consumers across the country including in Mississippi. But Mississippi has one of the highest percentages of Chapter 13 cases in the country.

The Rollins Law Firm can provide you with an expert bankruptcy lawyer from Jackson, MS to file Chapter 13 bankruptcy and deal with your difficult times with the best advice!

When Should You File for Chapter 13 Bankruptcy?

Chapter 7 is more popular because it is very simple, quick, and effective. Also, Chapter 7 can eliminate many types of debt without making any payments. The most important part of a Chapter 7 case is the discharge (elimination) of debt at the end of the case.

Chapter 13, on the other hand, involves a repayment plan to handle your debt. The plan will require you to make a bankruptcy payment for 3 to 5 years. The Chapter 13 plan is best suited to handle the following situations:

Who Is Allowed to File Chapter 13 in Mississippi?

You should meet the below criteria to file Chapter 13 bankruptcy:

- You must have regular income and enough income to make the bankruptcy payment.

- You must have filed all the tax returns you were required to file for the last 4 years

- You cannot have more than $419,175 in unsecured debt

- You cannot have more than $1,257,850 in secured debt

How Does a Chapter 13 Case Work?

First, a bankruptcy petition is filed to open a bankruptcy case. After the petition is filed the debtor needs to file a plan in 14 days. Usually, most people file the plans at the same time as the petition. The plan must include how long you plan to make payments, how much you believe the payment should be, and it must provide for how your debts will be treated.

Which Debts Do You Need to Pay?

You must pay the priority debts in full. These will include taxes, child support and alimony. Additionally, you can either surrender secured debts or pay them in the plan. If you choose to surrender the property, the creditor will be able to take possession of the property. In certain situations, a debtor can pay less than the full amount owed to keep the property.

For home loans, the debtor does not usually have to pay the loan in full. Instead, the debtor can just maintain the ongoing monthly payments while paying the arrears over the term of the plan.

If the mortgage is up to date when the case is filed then it may be possible to pay the debt directly rather than paying it through the trustee.

Besides, you must pay a certain percentage to unsecured debts. This percentage can range from 0% to 100% and is based on several factors. However, majorly it is based on your income and assets.

If you have a high income or low expenses then it is more likely that you will be required to pay a higher percentage to unsecured creditors. Also, if you own a lot of property you might have to pay back more of the unsecured debt.

Many attorneys will file the case without requiring you to pay all of the attorney’s fees upfront. Whatever balance you owe will be paid by the trustee.

Appointing a Trustee

A Chapter 13 trustee is appointed in every Mississippi Chapter 13 bankruptcy case. The trustee is usually a lawyer. And the trustee’s job is to review your paperwork and make sure your plan complies with the bankruptcy laws.

You will make your bankruptcy plan payments to the trustee and the trustee will use that money to pay the debts as outlined below. If the trustee does not agree with a part of your plan, they can file an objection. Common objections include:

- You cannot afford the bankruptcy payment

- You can afford to pay more to unsecured creditors

- You have not provided treatment in the plan for all of your debts

- You have not provided pay stubs, bank statements and tax returns to the trustee for

review

And if the trustee files an objection, it is up to the bankruptcy judge to decide.

T.C. Rollins is a Jackson, MS bankruptcy lawyer who also has offices in Hattiesburg and Gulfport, Mississippi. If You’re considering bankruptcy in Mississippi, call our office to schedule a consultation with us today.

Connect with Us