A bankruptcy filing helps an individual who is struggling with debt and financial problems, especially during these trying times. When you file for bankruptcy, it does not just help you repay all the debts on your creditor list. It also helps a debtor have a fresh start to secure his or her financial future. Bankruptcy laws seem simple but to avoid any misunderstanding and problems during the bankruptcy process, it is highly recommended for you to hire an experienced bankruptcy attorney.

What are the Different Types of Consumer Bankruptcy?

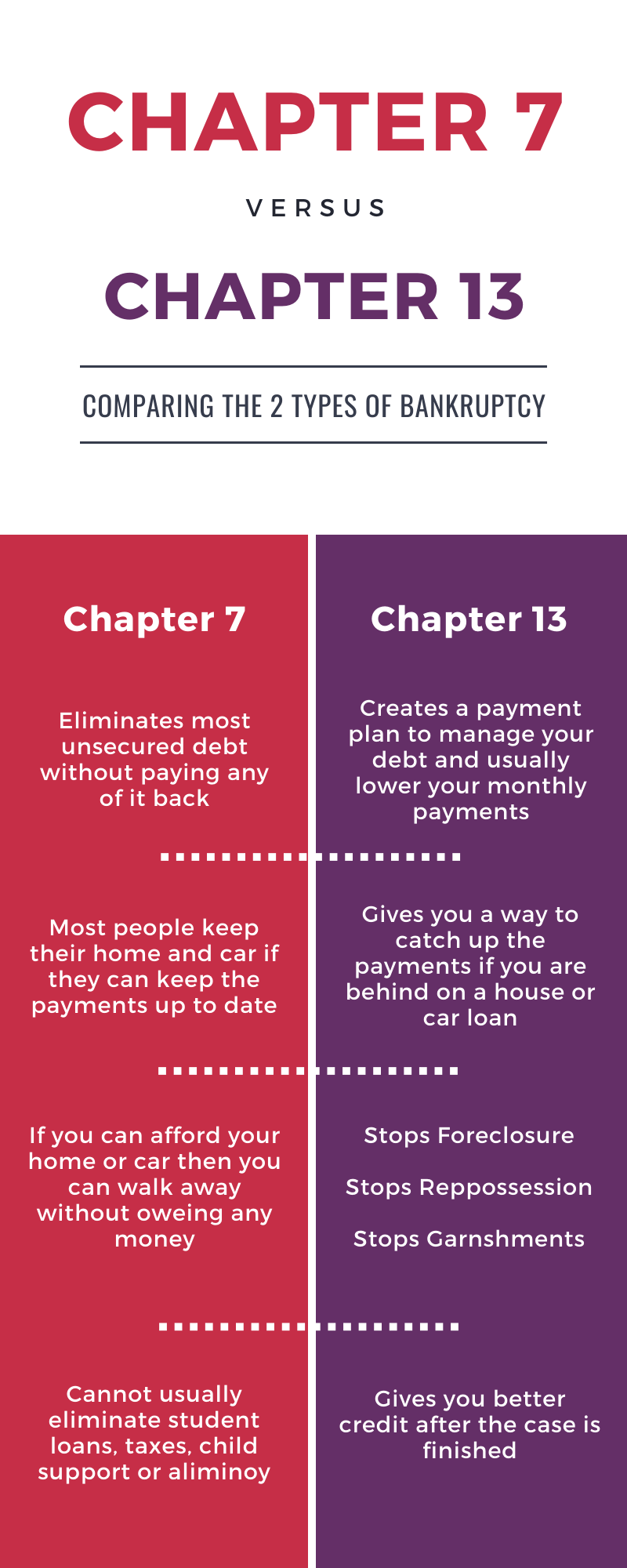

There are two types of bankruptcy that you may choose from, depending on the types of debt and the amount of debt you owe. These are Chapter 7 or the liquidation bankruptcy and Chapter 13 or the reorganization bankruptcy.

When filing Chapter 7, your nonexempt assets shall be liquidated, which could be a disadvantage to some. One of the main roles of a trustee in bankruptcy cases is to manage the sales and facilitate the distribution of proceeds to certain lenders and debt collectors. One of the advantages that come with bankruptcy cases, meanwhile, is the list of discharge debt. When you file for a petition in bankruptcy, your unsecured debt will be discharged or eliminated. In some liquidation bankruptcy filings, even certain secured debt may be eliminated.

In a bankruptcy filing under Chapter 13, you may keep your properties as long as you are capable of making your scheduled monthly payments to creditors. Depending on the financial status of the bankrupt individual, generally, all types of loans are to be repaid. In the usual bankruptcy procedure, however, remaining debt at the end of the repayment plan may also be eliminated.

What are the Pros of Filing a Bankruptcy Petition?

Although not guaranteed, some individuals start seeing a rise in their credit score upon getting a bankruptcy discharge. The explanation for this is the dramatic shift in one’s debt to income ratio. Your debt to income ratio is probably high on the debt side of the scale before a bankruptcy filing. Since your debts are reduced when you obtain a discharge, your debt to income ratio improves even if your monthly income remains the same. Such are among the variables taken into consideration when your credit score is calculated.

Whether or not you see your credit score rise instantly, you will eventually be able to improve your financial status after securing a bankruptcy discharge. Rebuilding everything in life rarely takes a short period, so you should concentrate on your declaration of bankruptcy first and worry about rebuilding credit after.

What are the Cons of a Bankruptcy Proceeding?

The issues that may arise when you file bankruptcy are short-lived and may be resolved quickly. A bankruptcy declaration could remain on your credit report for up to ten years. It could be a disturbing idea at first glance but you can begin to improve your credit score shortly after a bankruptcy filing. Bankruptcies may be frustrating but in the long run, they would make life simpler for you.

If you are starting to get offers for car loans or from credit card companies, bankruptcy attorneys will advise you not to take any of these immediately after filing bankruptcy given the high-interest rates in such loans.

If you are anxious about the uncertainty of things, bankruptcy lawyers will assist you before, during, and after bankruptcy.

While dealing with debt problems will never be easy, bankruptcy filings can help you wipe out your debts without having to pay all of them. Consult with a bankruptcy lawyer who will work with you. Contact us at the Rollins Law Firm for legal help and assistance.

Connect with Us