Filing Bankruptcy

Filing bankruptcy is a tough decision you might understandably not want to share with anyone (besides your lawyer). It’s no surprise that you may feel tempted to file bankruptcy without your spouse if they don’t know about your financial difficulties. But before you exclude your spouse from this important decision, there are a few things you should know.

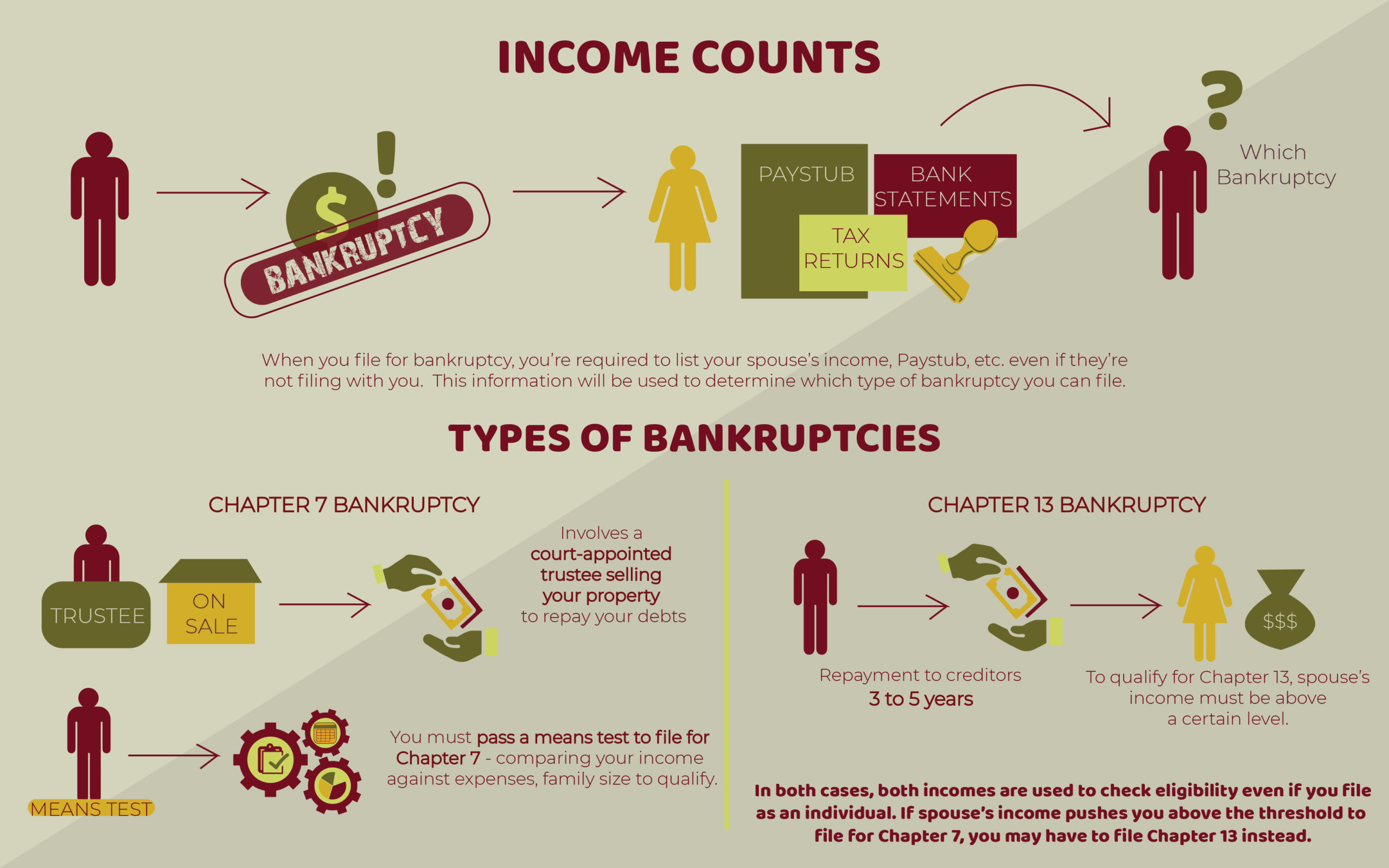

Income Counts

When you file for bankruptcy, you’re required to list your spouse’s income even if they’re not filing with you. As such, you’ll need to get proof of your spouse’s income, like a paystub, tax returns, and maybe their bank statements. This information will be used to determine which type of bankruptcy you can file.

There are 2 main types of bankruptcy:

Chapter 7 bankruptcy, also called liquidation bankruptcy, involves a court-appointed trustee selling your property to repay your debts. You must pass a means test to file for Chapter 7, which means comparing your income against expenses and family size to qualify.

Chapter 13 bankruptcy involves entering a repayment plan with your creditors for 3 to 5 years. To qualify for Chapter 13, your spouse’s income must be above a certain level.

As you can see, in both cases, both incomes are used to check eligibility even as it pertains to filing as an individual. If your spouse’s income pushes you above the threshold to file for Chapter 7, you may have to file Chapter 13 instead.

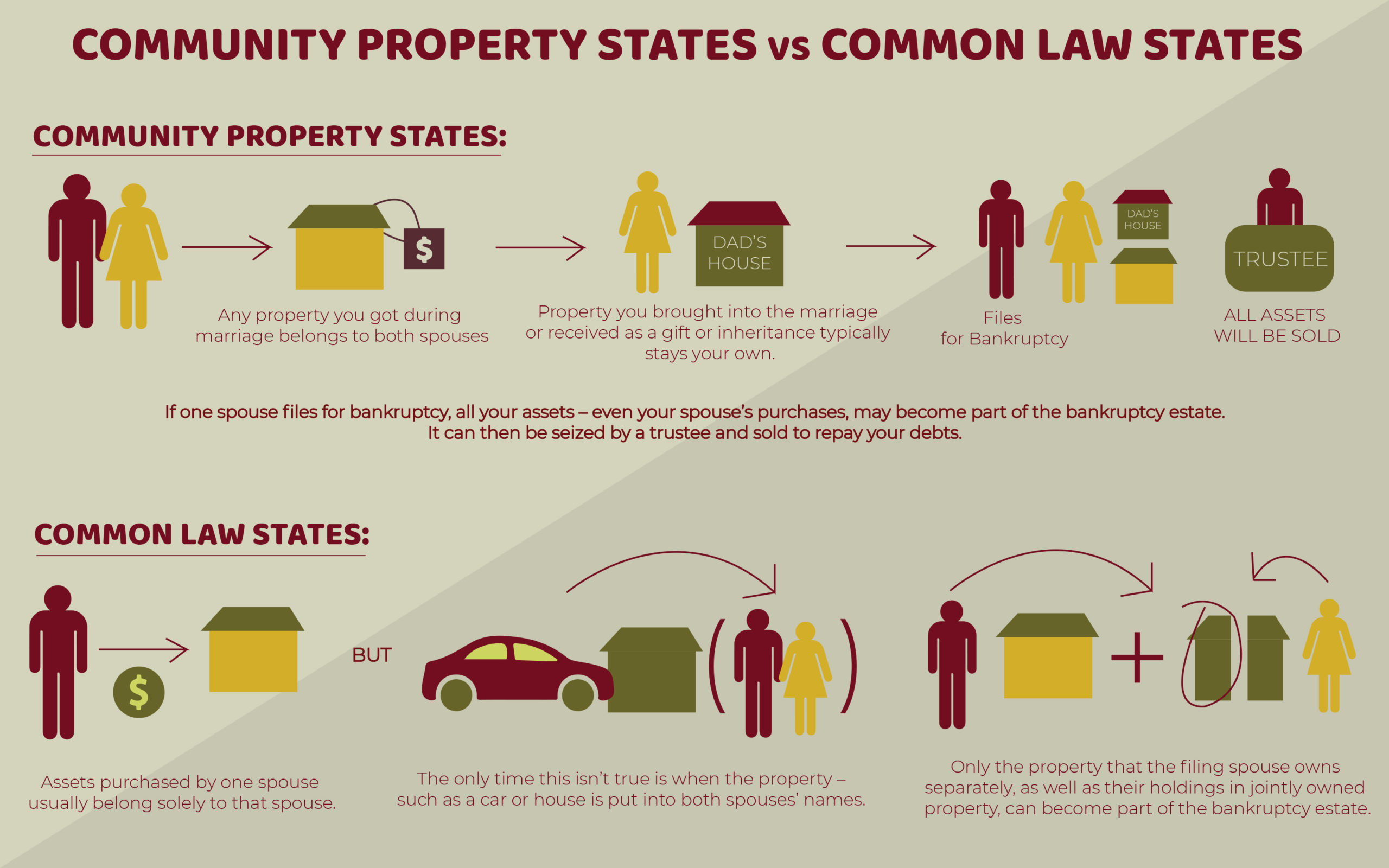

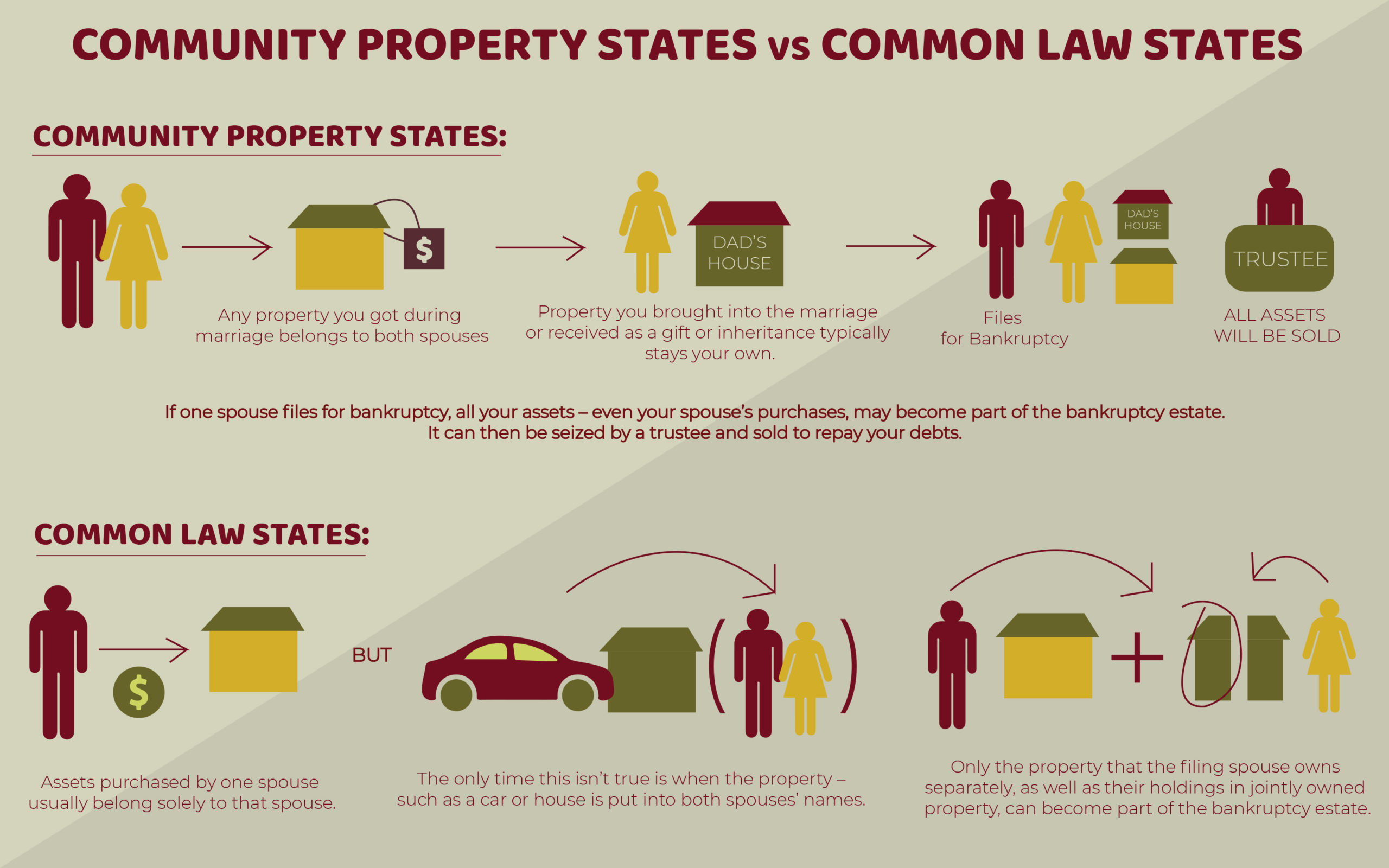

Community Property State vs. Common Law States

Each state has different laws about marital property and debts. But you can divide all states into two categories: community property and common law states. Knowing which system your state uses can change your bankruptcy plans.

Community Property States

In community property states, any property you got during the marriage belongs to both spouses. The property you brought into the marriage or received as a gift or inheritance typically stays your own. Everything else belongs to each partner equally.

In community property states, if one spouse files for bankruptcy, all your assets – even the ones your spouse purchased – may become part of the bankruptcy estate. It can then be seized by a trustee and sold to repay your debts.

Common-Law States

In common law states, assets purchased by one spouse usually belong solely to that spouse. Typically, the only time this isn’t true is when the property – such as a car or house – is put into both spouses’ names.

Only the property that the filing spouse owns separately, as well as their holdings in jointly owned property, can become part of the bankruptcy estate.

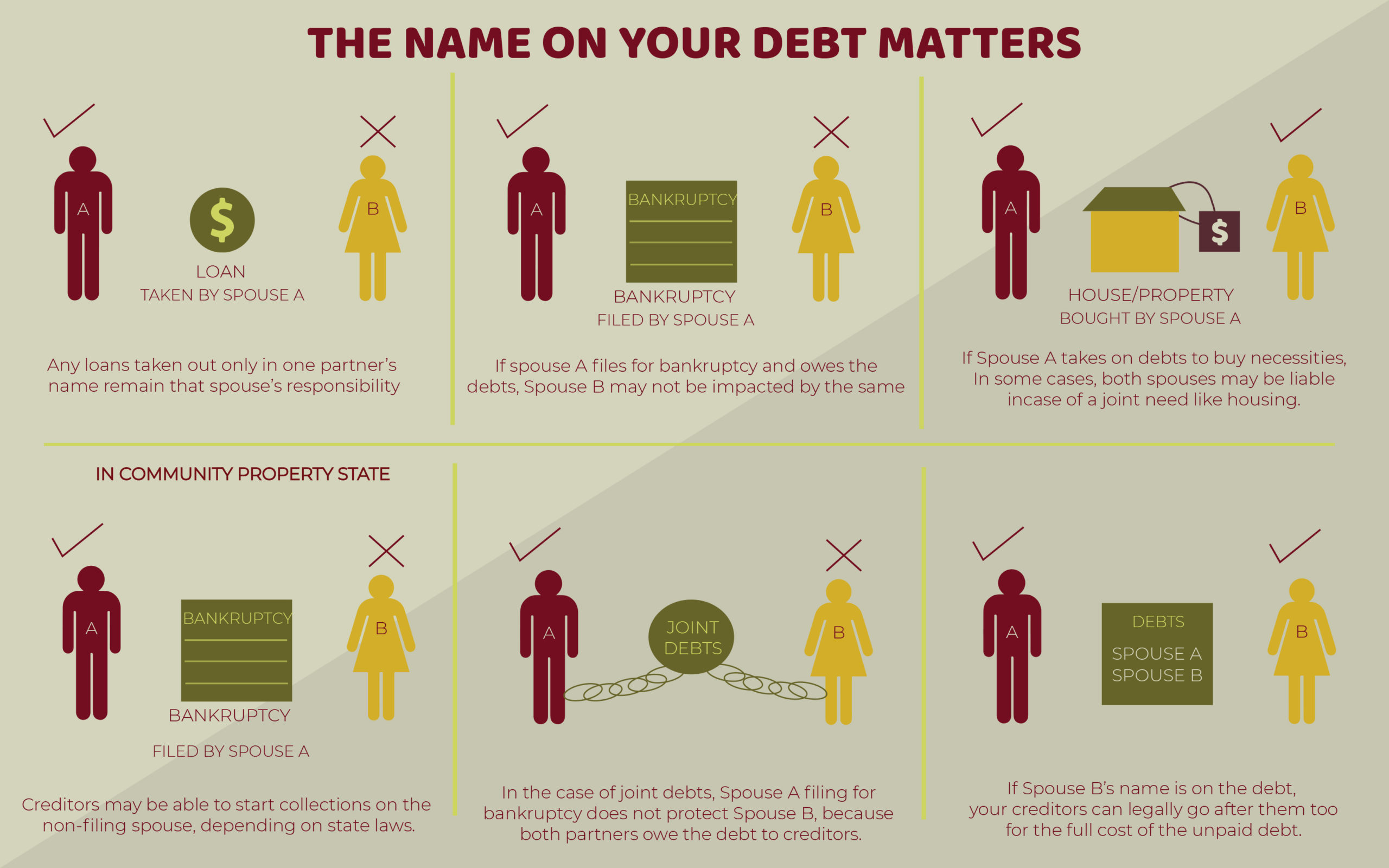

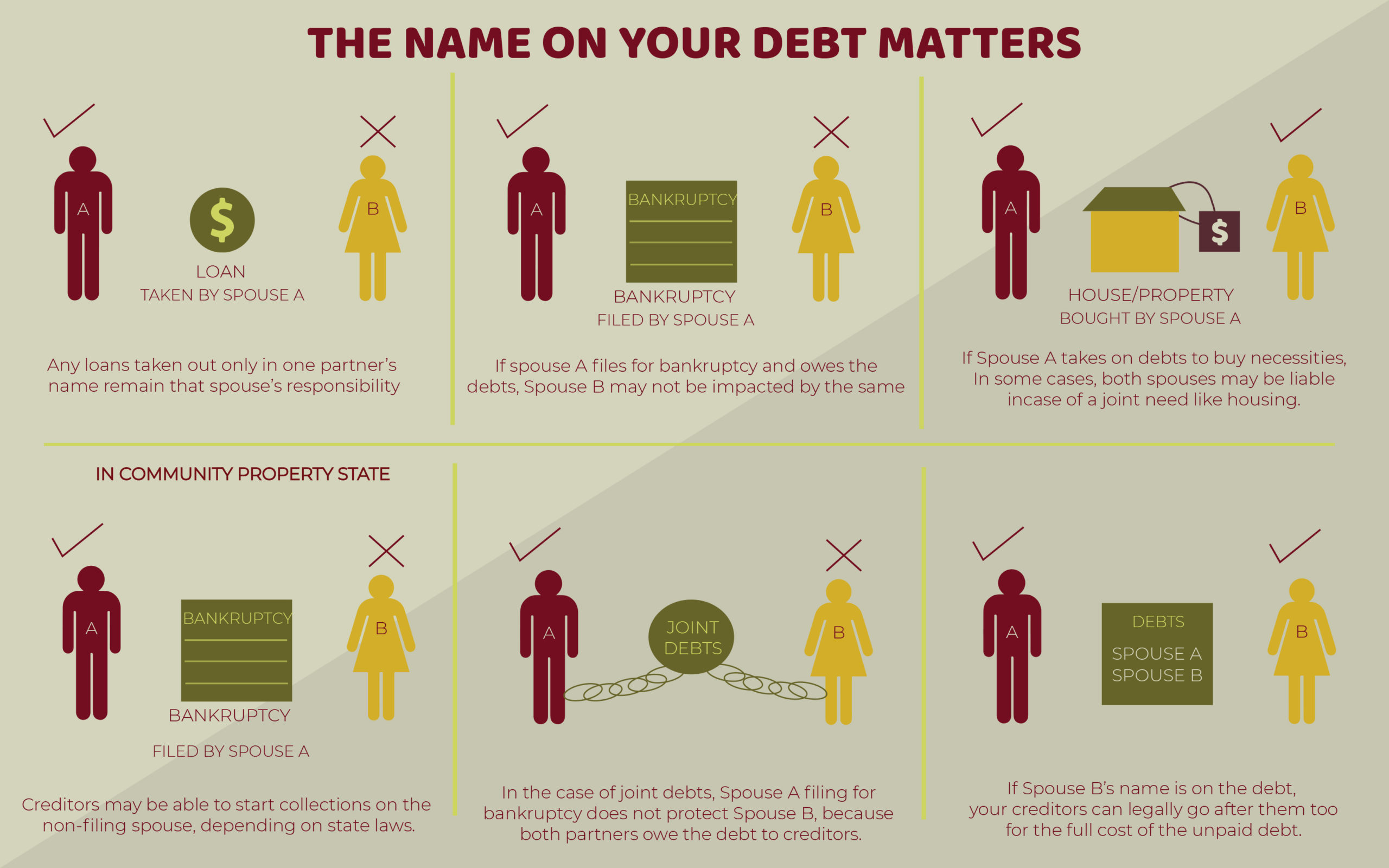

The Name on Your Debt Matters

Marrying someone doesn’t mean that you automatically take on their financial responsibilities. In most situations, any loans taken out only in one partner’s name remain that spouse’s responsibility. Therefore, if the spouse that files for bankruptcy is the one who owes the debts, their partner may not be impacted by bankruptcy filings.

However, this may not be true if one partner takes on debts to buy necessities. In some cases, both spouses may be liable if one takes out debts to fulfill a joint need like housing. Additionally, if you’re in a community property state, creditors may be able to start collections on the non-filing spouse, depending on state laws.

In the case of joint debts, one spouse filing for bankruptcy does not protect the non-filing spouse, because both partners owe the debt to creditors. If your non-filing spouse’s name is on the debt, your creditors can legally go after your non-filing spouse for the full cost of the unpaid debt.

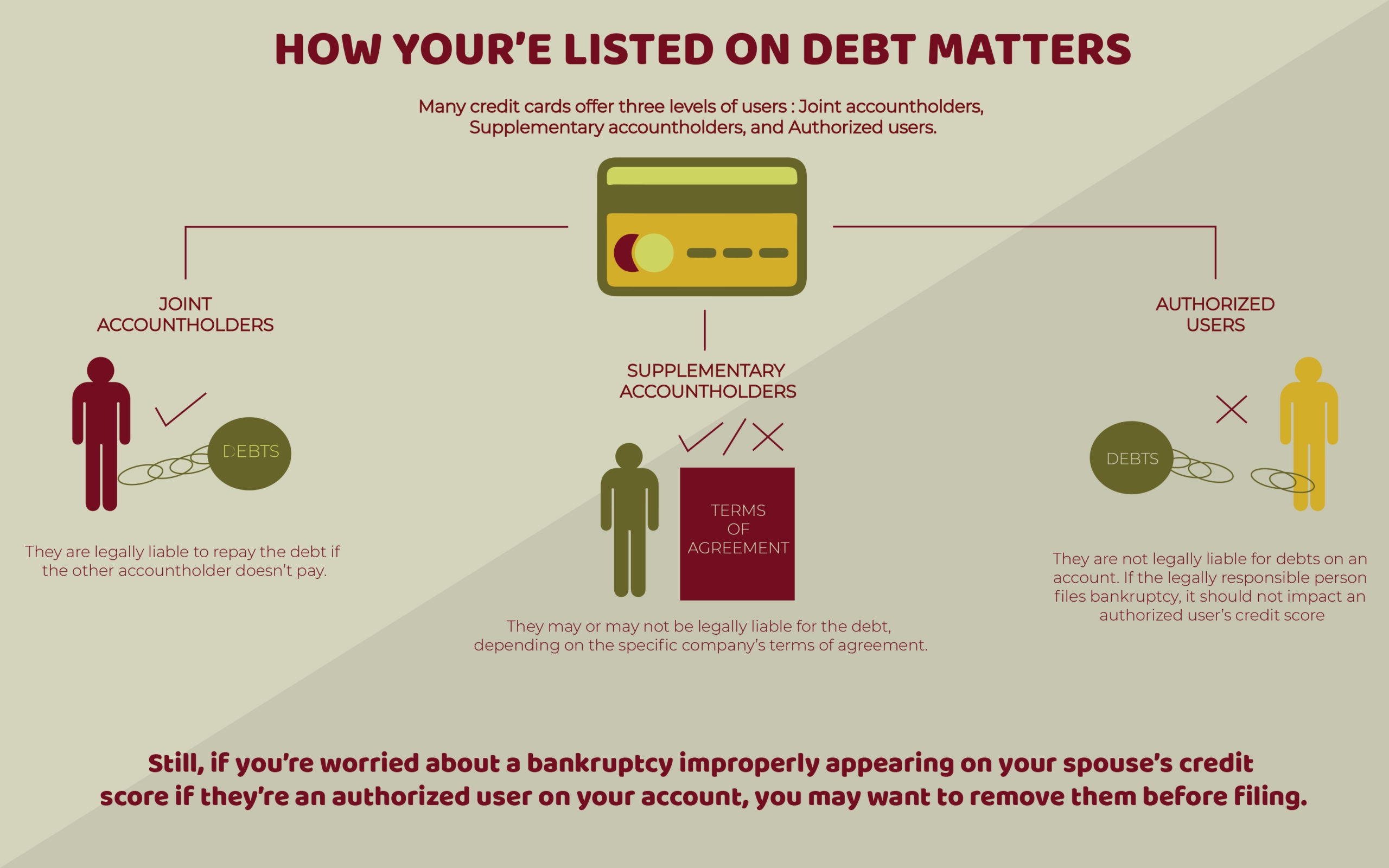

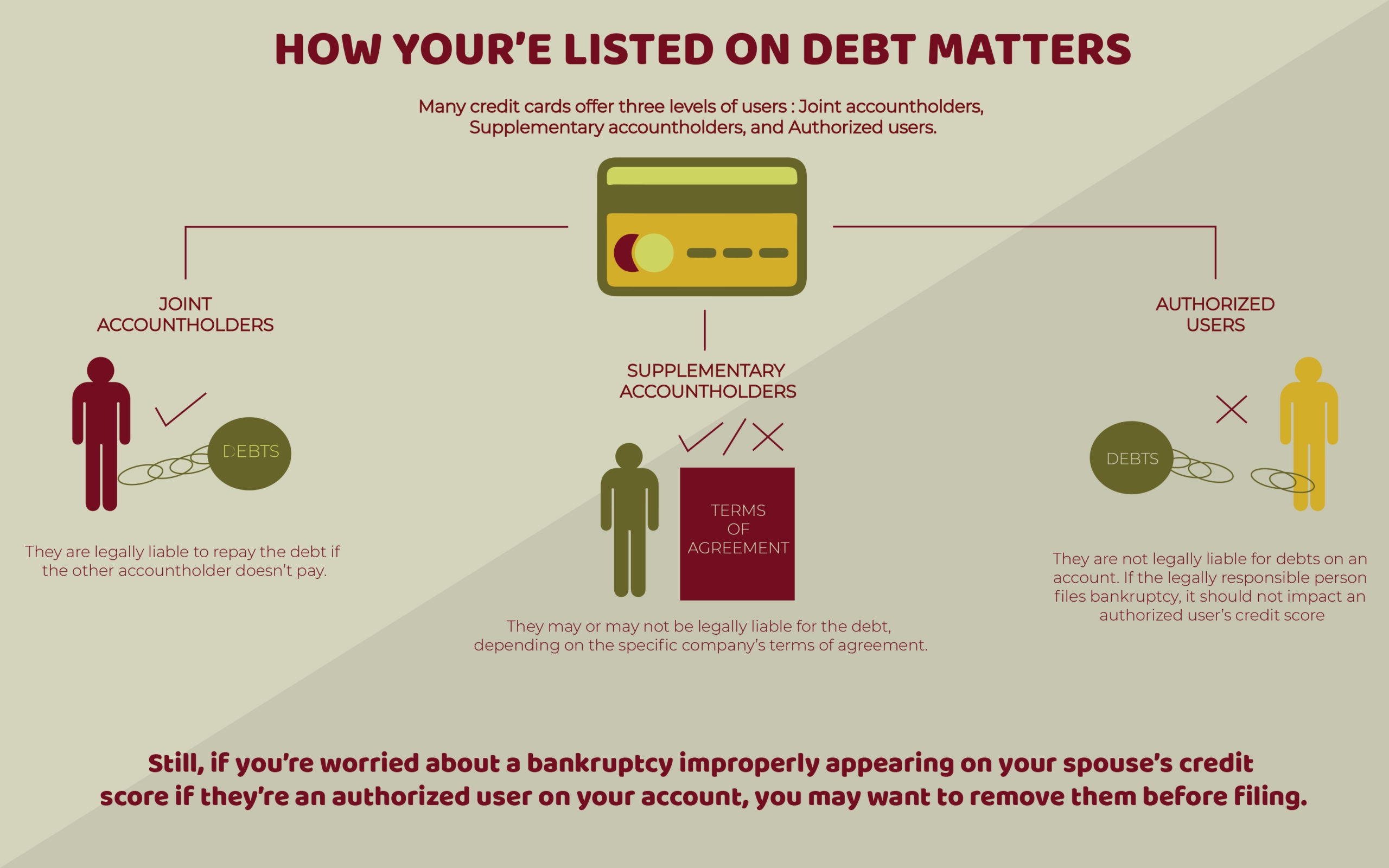

How You’re Listed on Debt Matters

Whether your non-filing spouse is listed on your debt matters. But how they’re listed also matters.

Take credit cards. Many credit cards offer three levels of users: joint account holders, supplementary accountholders, and authorized users. The terms of agreement explain the role and liability that each plays:

- Joint account holders are legally liable to repay the debt if the other account holder doesn’t

- Supplementary accountholders may or may not be legally liable for the debt, depending on the specific company’s terms of the agreement

- Authorized users are not legally liable for debts on an account. If the legally responsible person files bankruptcy, it should not impact an authorized user’s credit score

Still, if you’re worried about a bankruptcy improperly appearing on your spouse’s credit score if they’re an authorized user on your account, you may want to remove them before filing.

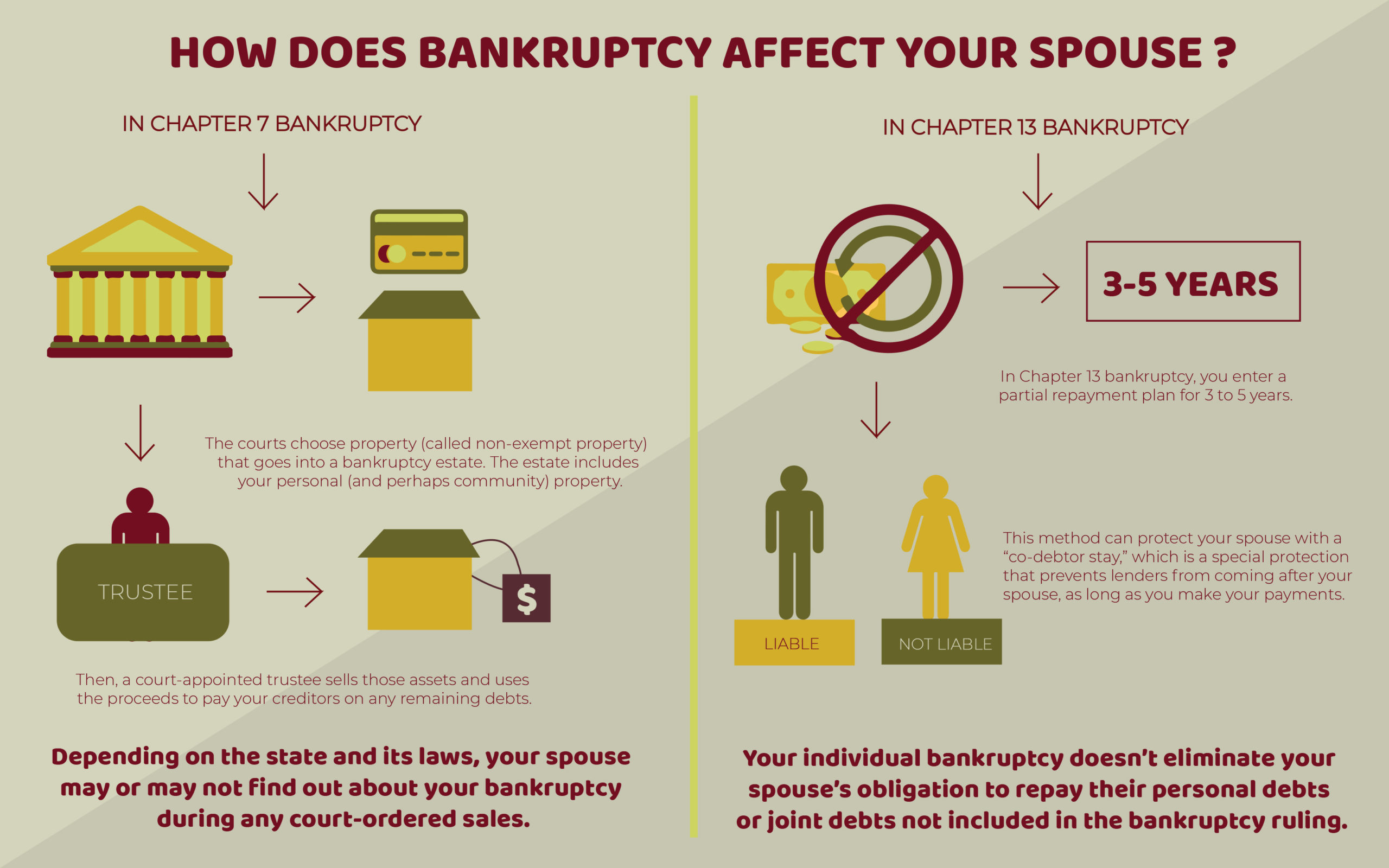

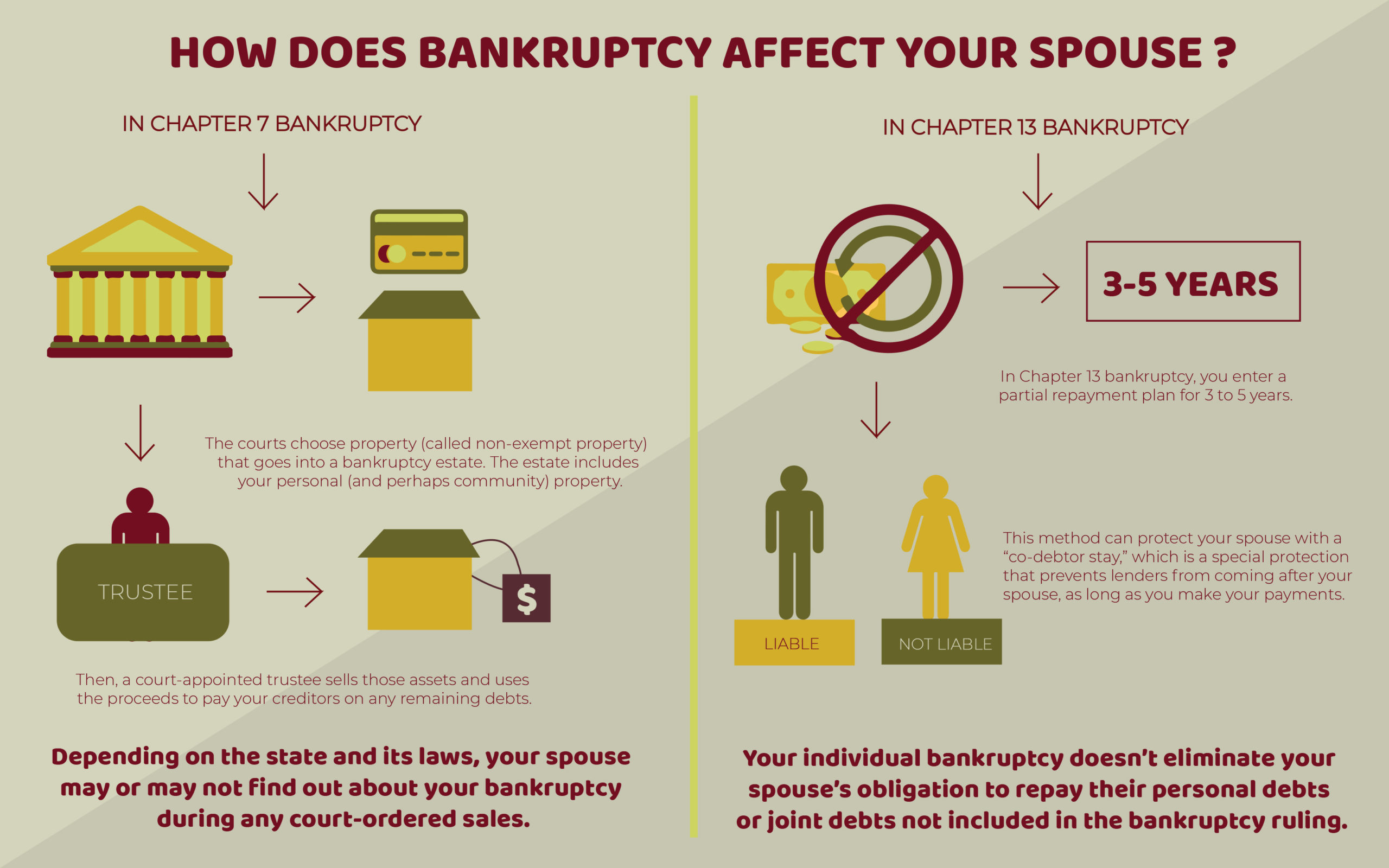

How Does Bankruptcy Affect Your Spouse?

In Chapter 7 bankruptcy, the courts choose property (called non-exempt property) that goes into a bankruptcy estate. The estate includes your personal (and perhaps community) property. Then, a court-appointed trustee sells those assets and uses the proceeds to pay your creditors on any remaining debts.

Depending on the state and its laws, your spouse may or may not find out about your bankruptcy during any court-ordered sales.

In Chapter 13 bankruptcy, you enter a partial repayment plan for 3 to 5 years. This method can protect your spouse with a “codebtor stay,” which is a special protection that prevents lenders from coming after your spouse, as long as you make your payments.

However, your individual bankruptcy doesn’t eliminate your spouse’s obligation to repay their personal debts or joint debts not included in the bankruptcy ruling.

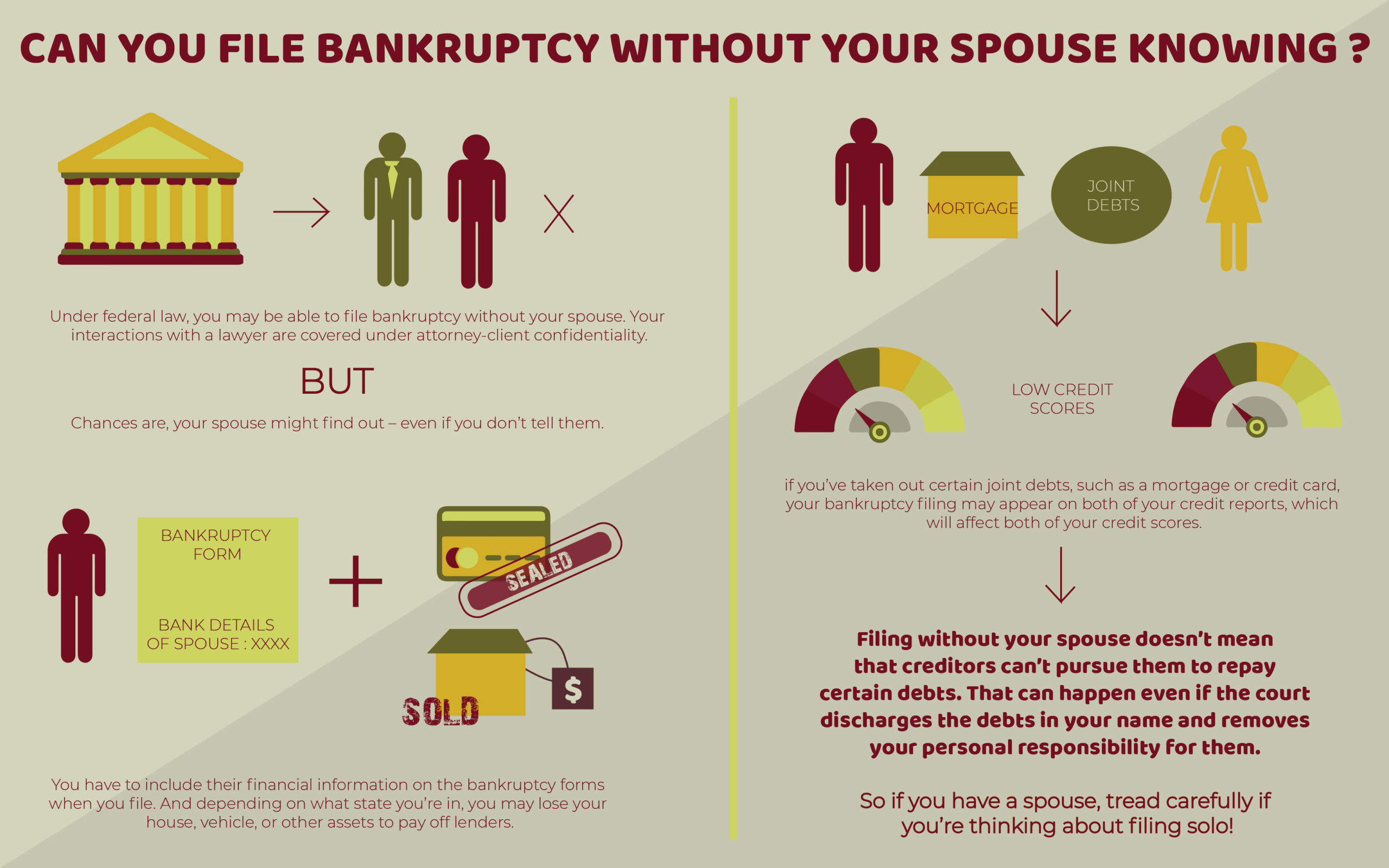

Can You File Bankruptcy Without Your Spouse Knowing?

Under federal law, you may be able to file bankruptcy without your spouse. Your interactions with a lawyer are covered under attorney-client confidentiality, but there are a few ways your spouse may still have to get involved. Chances are, your spouse might find out – even if you don’t tell them.

To start, you have to include their financial information on the bankruptcy forms when you file. And depending on what state you’re in, you may lose your house, vehicle, or other assets to pay off lenders.

Additionally, if you’ve taken out certain joint debts, such as a mortgage or credit card, your bankruptcy filing may appear on both of your credit reports, which will affect both of your credit scores. Filing without your spouse also doesn’t mean that creditors can’t pursue them to repay certain debts. That’s true even if the court discharges the debts in your name and removes your personal responsibility for them.

So if you have a spouse, tread carefully if you’re thinking about filing solo!

Consult a Mississippi Bankruptcy Attorney Today!

If you’re thinking about filing bankruptcy, it is important that you seek the legal assistance of a reliable bankruptcy attorney in Mississippi. Schedule a consultation with us today to know how we can help.

Connect with Us