Paying for school is a nerve-wracking challenge. Not only is it expensive, but you’re usually signing up for debt for years to come. When you take out a larger loan, especially to pay for education, it can be difficult to grasp how long and how much money it will actually take to repay it.

If you’re struggling to repay your student loans, it might be time to modify your loan and change the terms. By lowering your interest rate, monthly payment, or even delaying payments for a month or two, you can make your debt more manageable. But when, how, and if you can modify your loan varies widely based on your lender. Read on to know more about student loan modifications.

Types of Student Loan Modifications

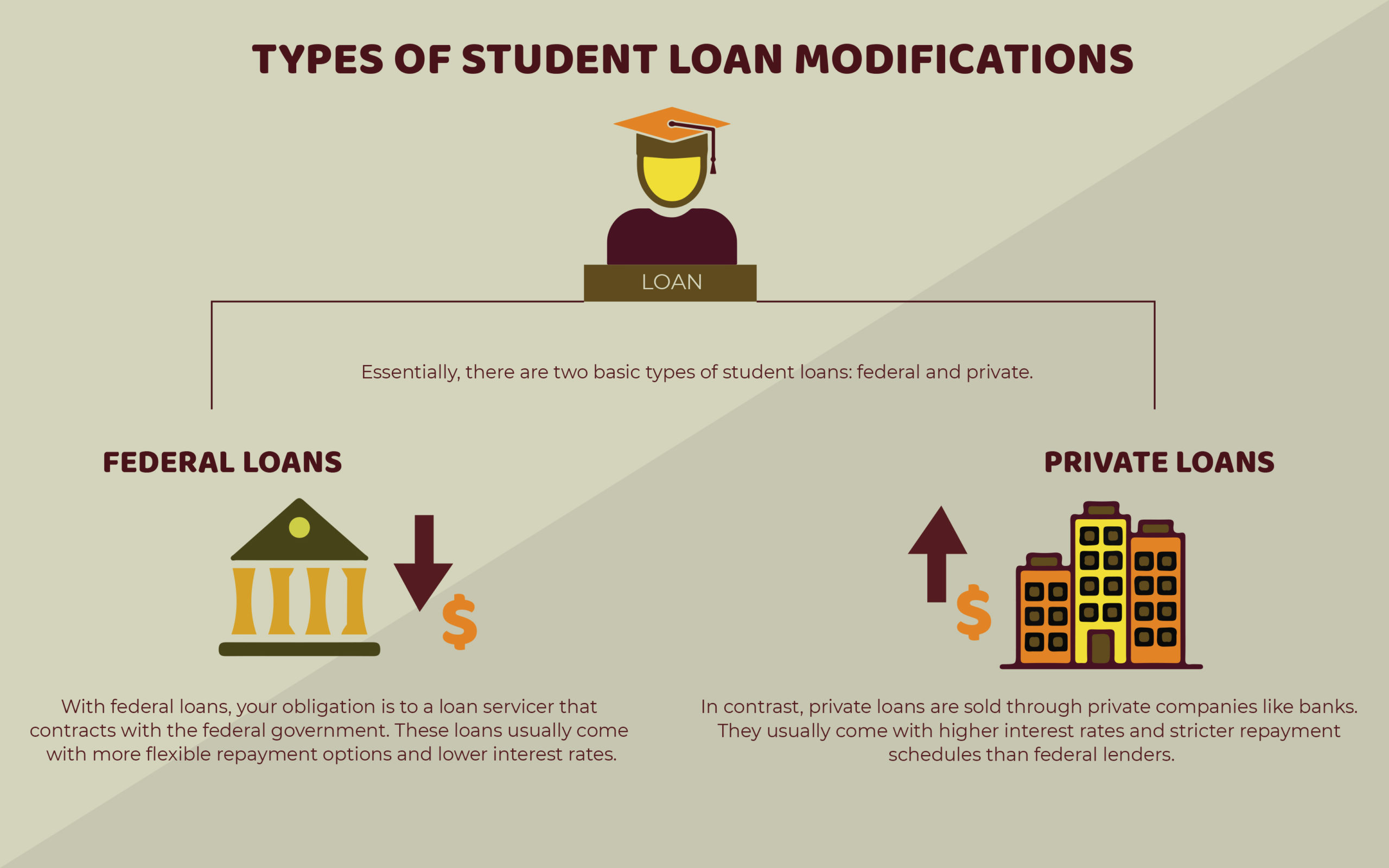

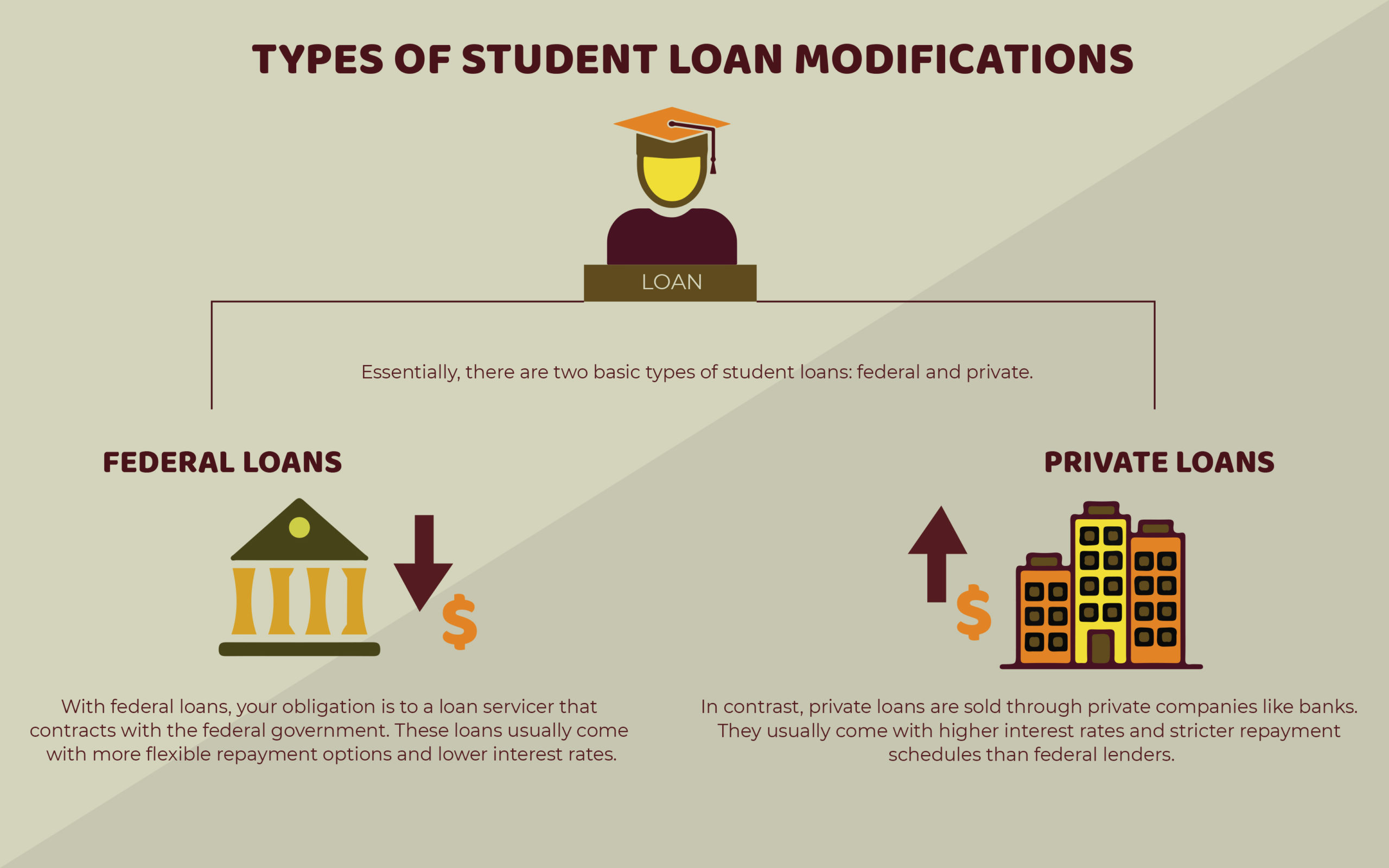

Essentially, there are two basic types of student loans: federal and private.

Federal Loans

With federal loans, your obligation is to a loan servicer that contracts with the federal government. These loans usually come with more flexible repayment options and lower interest rates.

Private Loans

In contrast, private loans are sold through private companies like banks. They usually come with higher interest rates and stricter repayment schedules than federal lenders.

Let’s look at the different ways you can modify both types of loans.

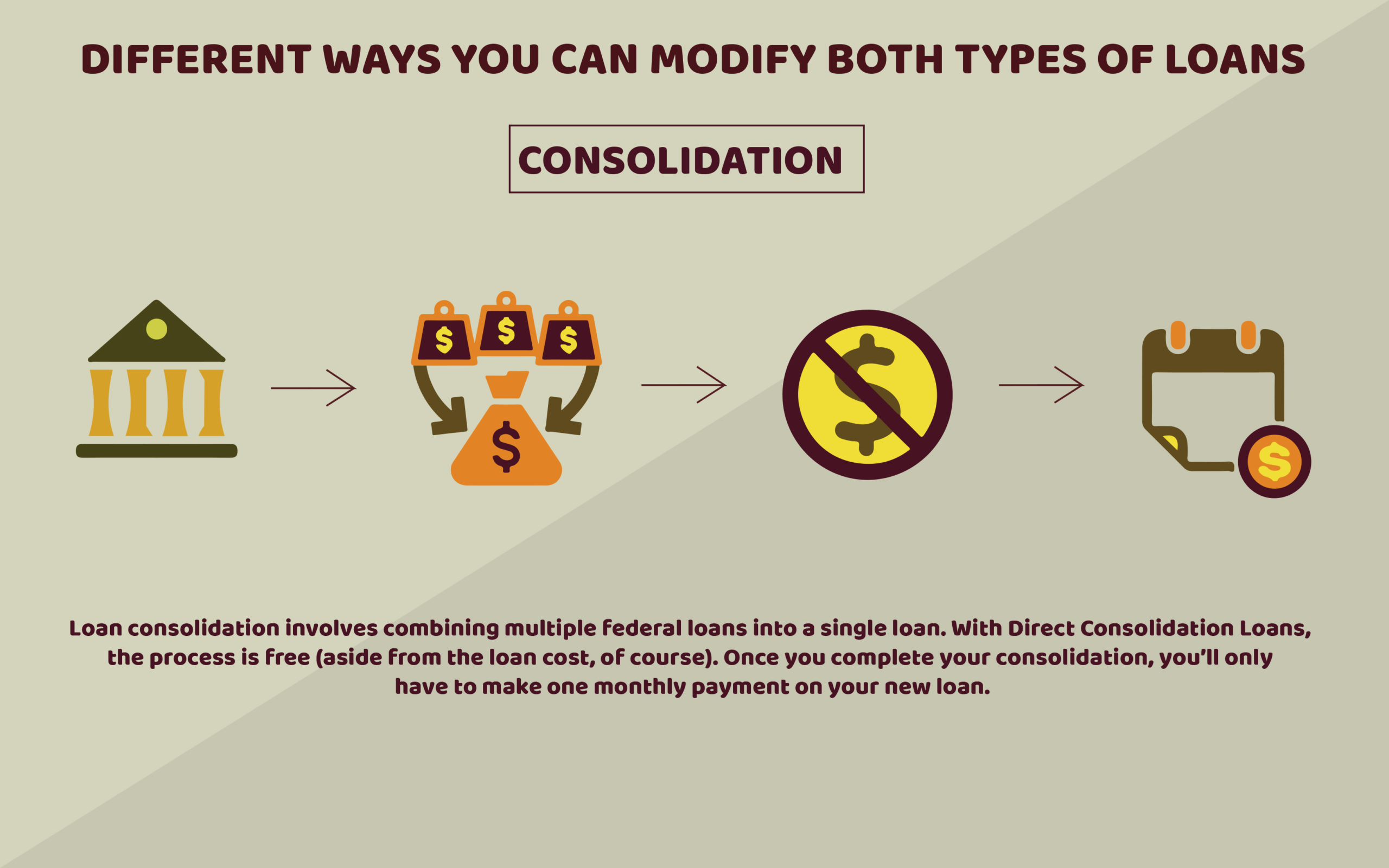

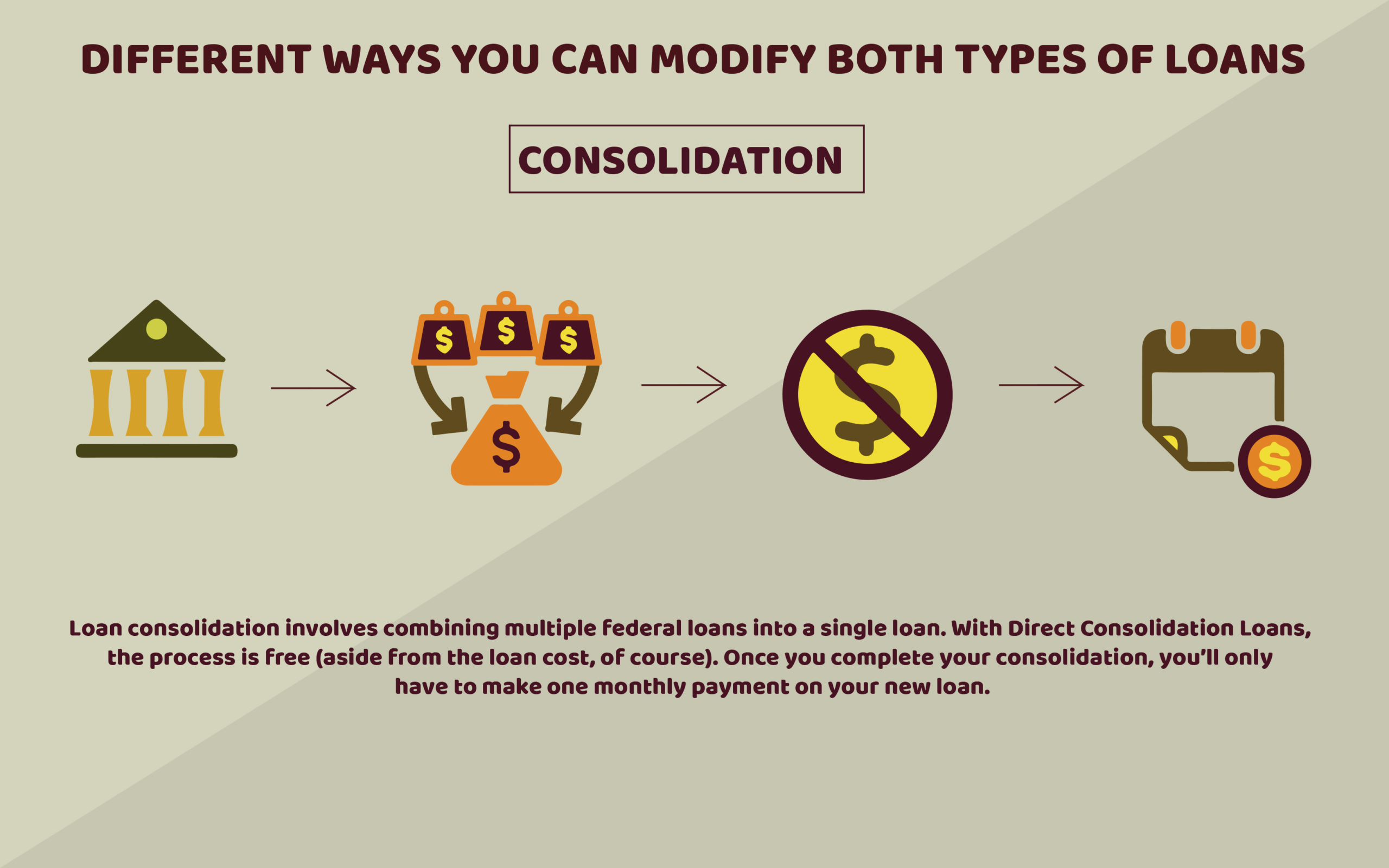

Consolidation

Loan consolidation involves combining multiple federal loans into a single loan. With Direct Consolidation Loans, the process is free (aside from the loan cost, of course). Once you complete your consolidation, you’ll only have to make one monthly payment on your new loan.

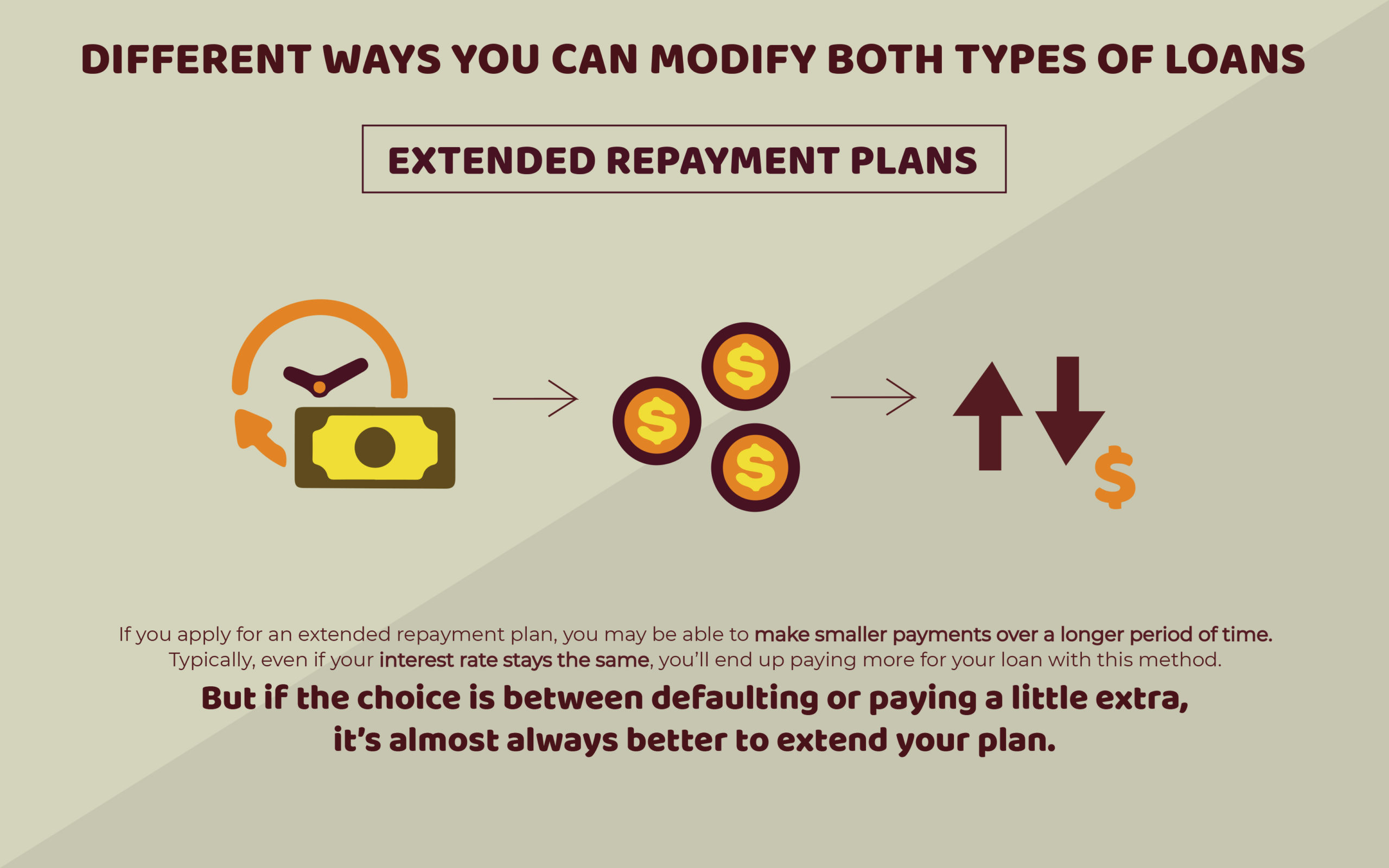

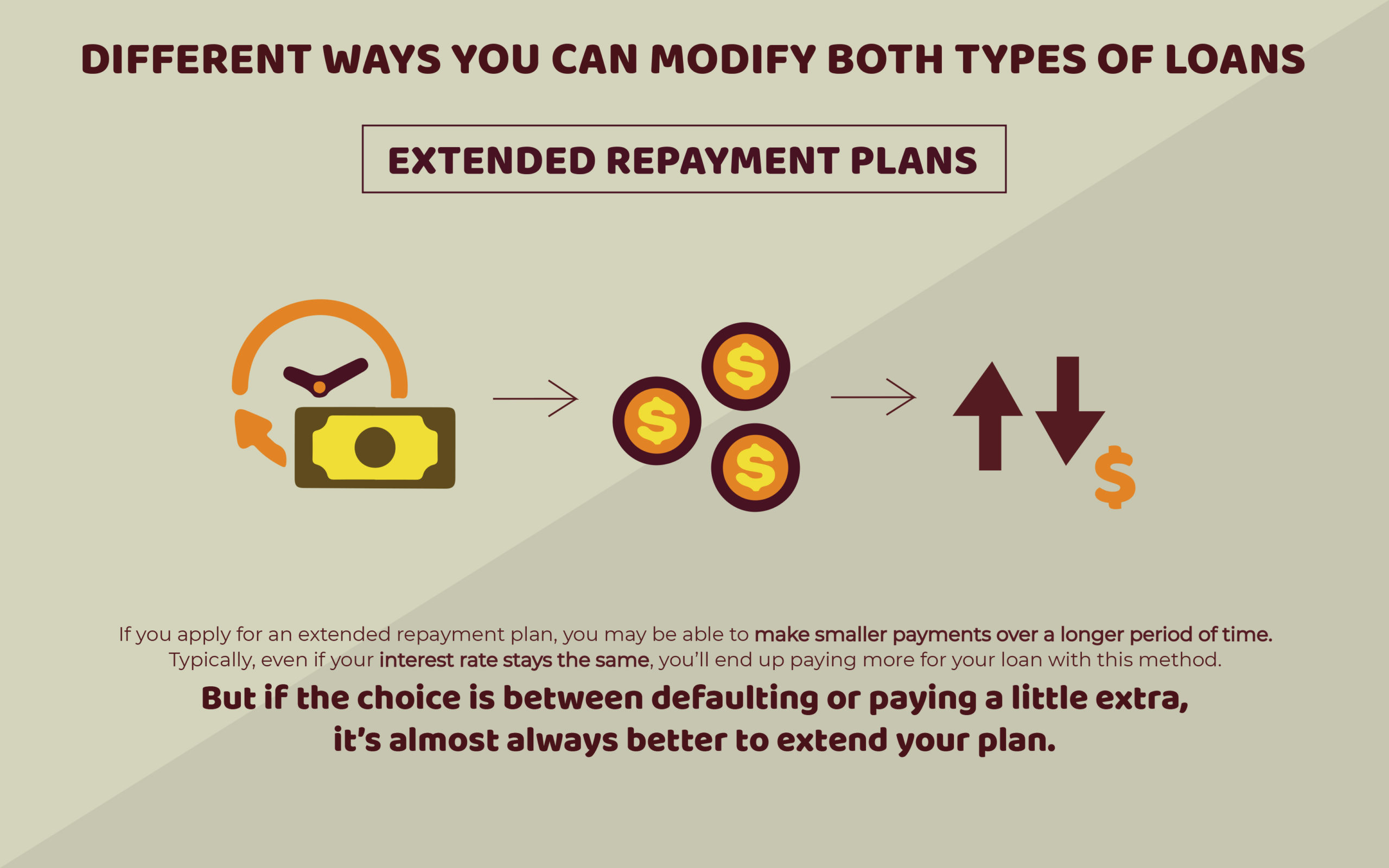

Extended Repayment Plans

If you apply for an extended repayment plan, you may be able to make smaller payments over a longer period of time. Typically, even if your interest rate stays the same, you’ll end up paying more for your loan with this method. But if the choice is between defaulting or paying a little extra, it’s almost always better to extend your plan.

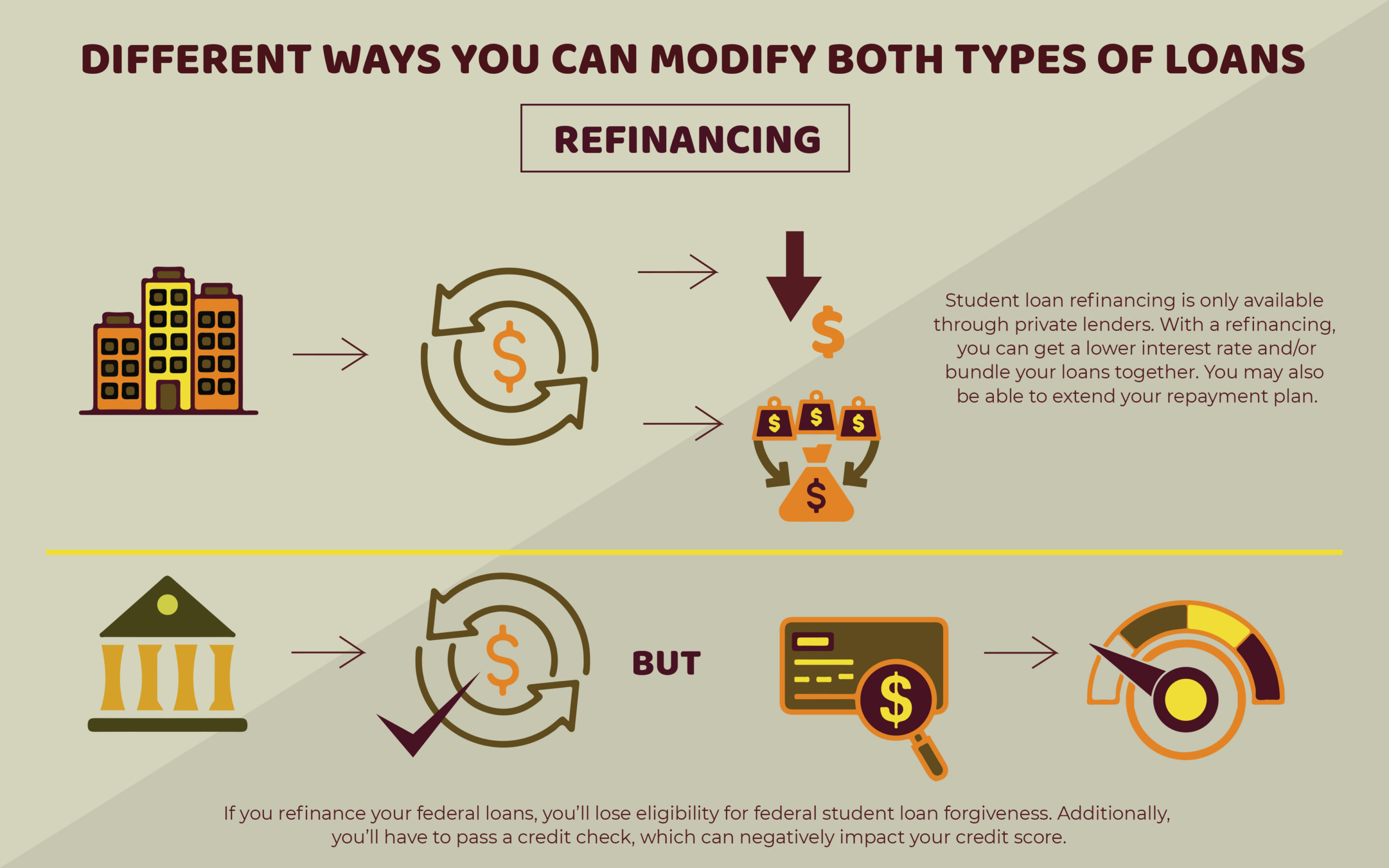

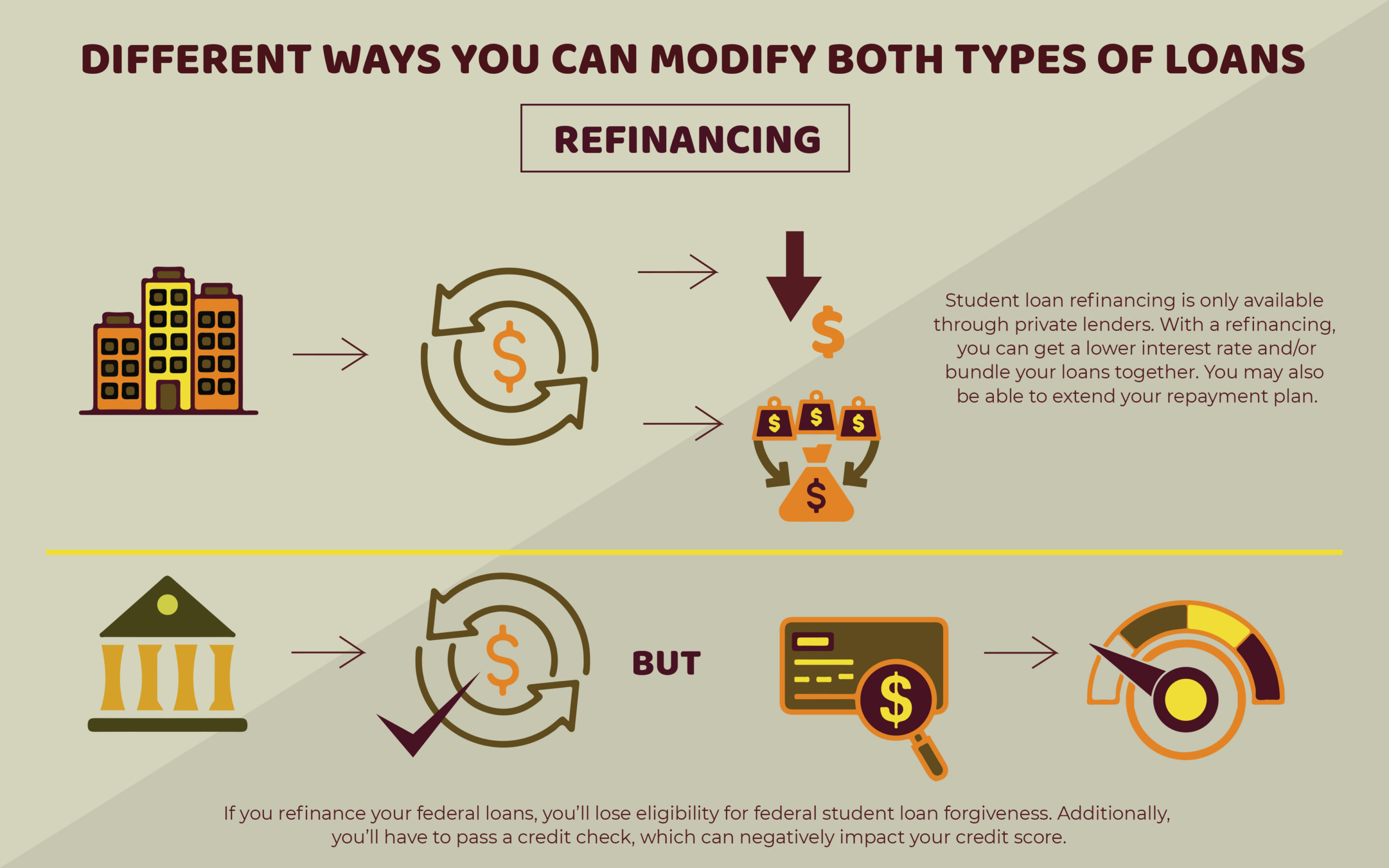

Refinancing

Student loan refinancing is only available through private lenders. With refinancing, you can get a lower interest rate and/or bundle your loans together. You may also be able to extend your repayment plan.

You can refinance both private and federal loans. But if you refinance your federal loans, you’ll lose eligibility for federal student loan forgiveness. Additionally, you’ll have to pass a credit check, which can negatively impact your credit score.

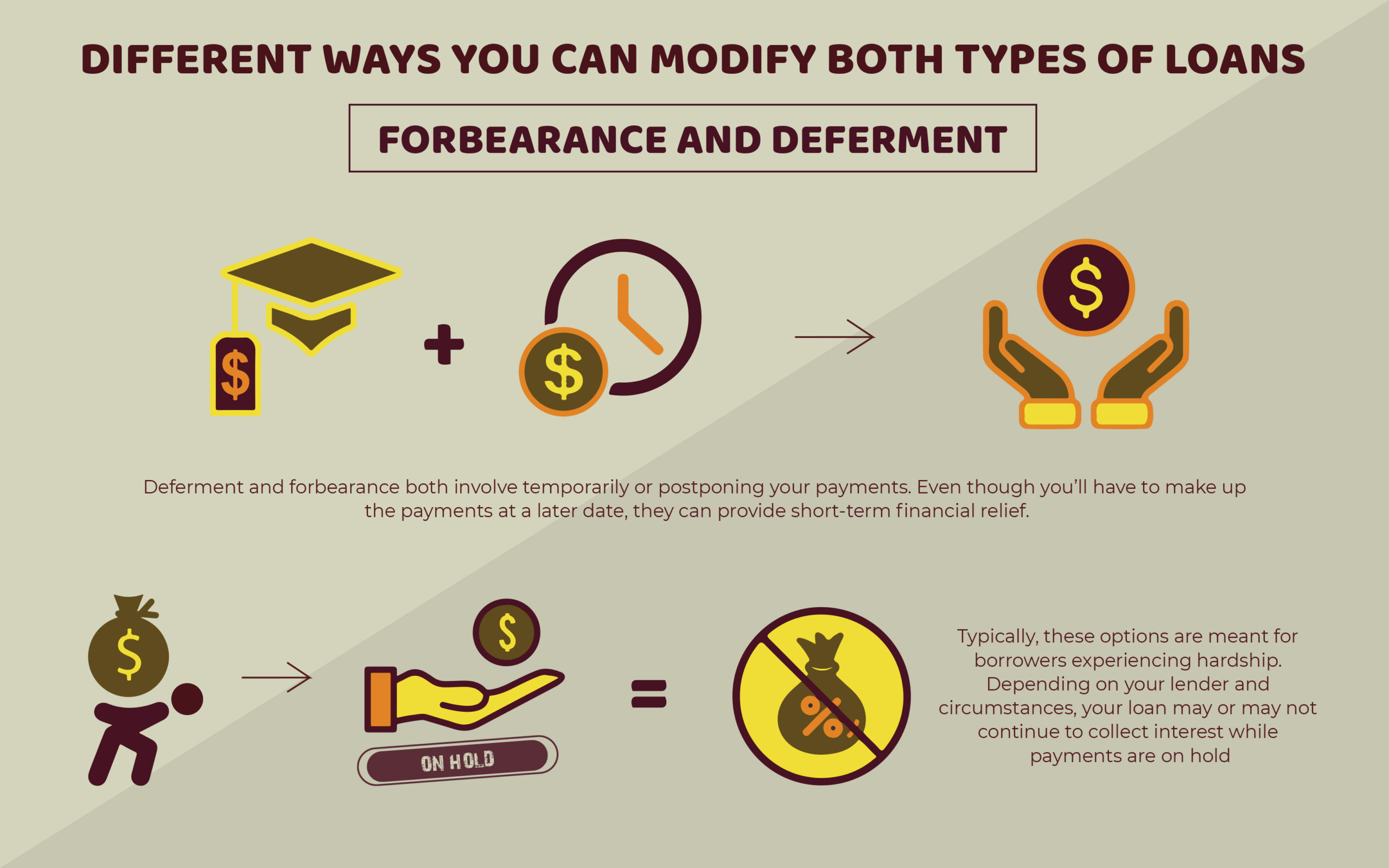

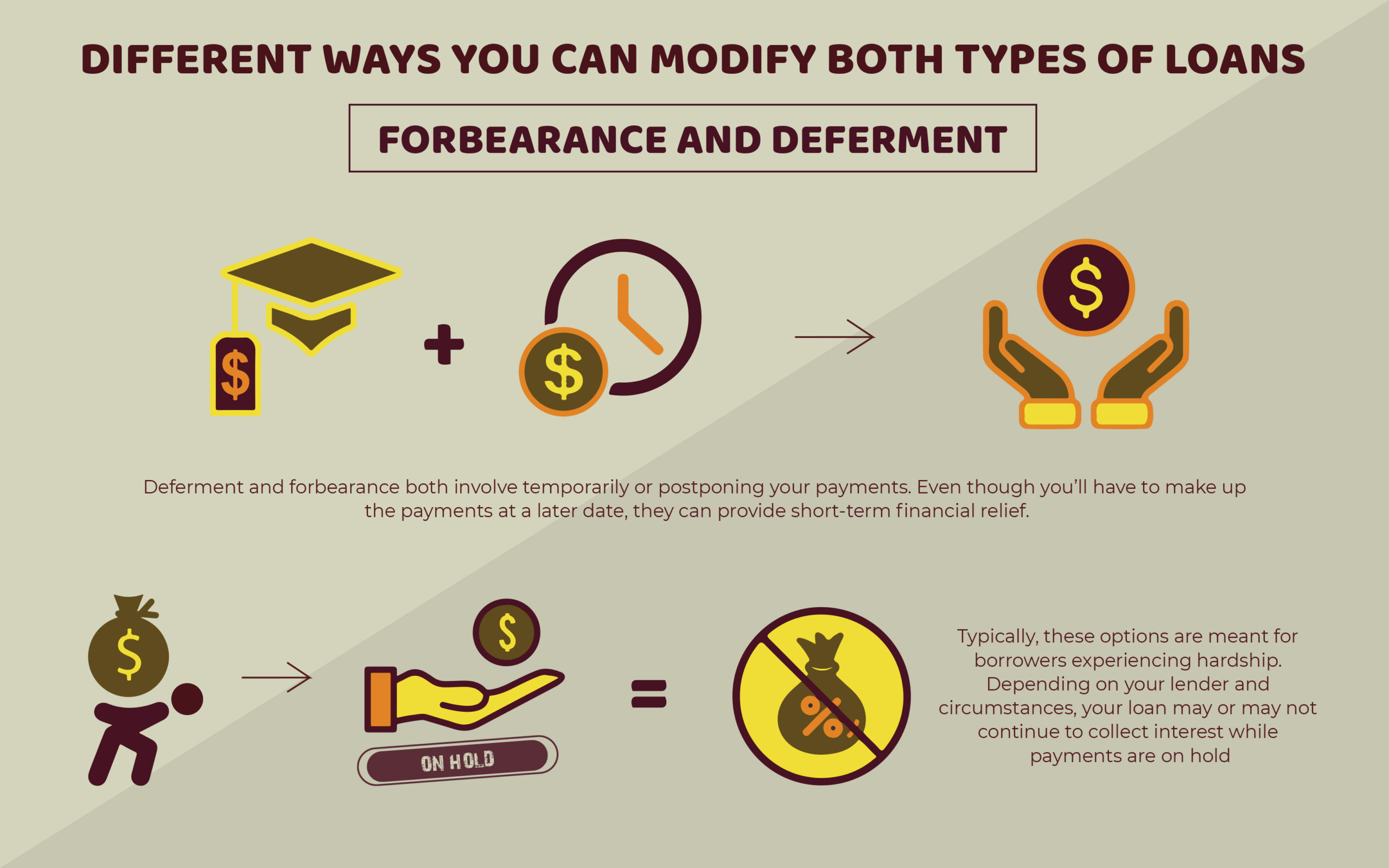

Forbearance and Deferment

Deferment and forbearance both involve temporarily or postponing your payments. Even though you’ll have to make up the payments at a later date, they can provide short-term financial relief.

Typically, these options are meant for borrowers experiencing hardship. Depending on your lender and circumstances, your loan may or may not continue to collect interest while payments are on hold.

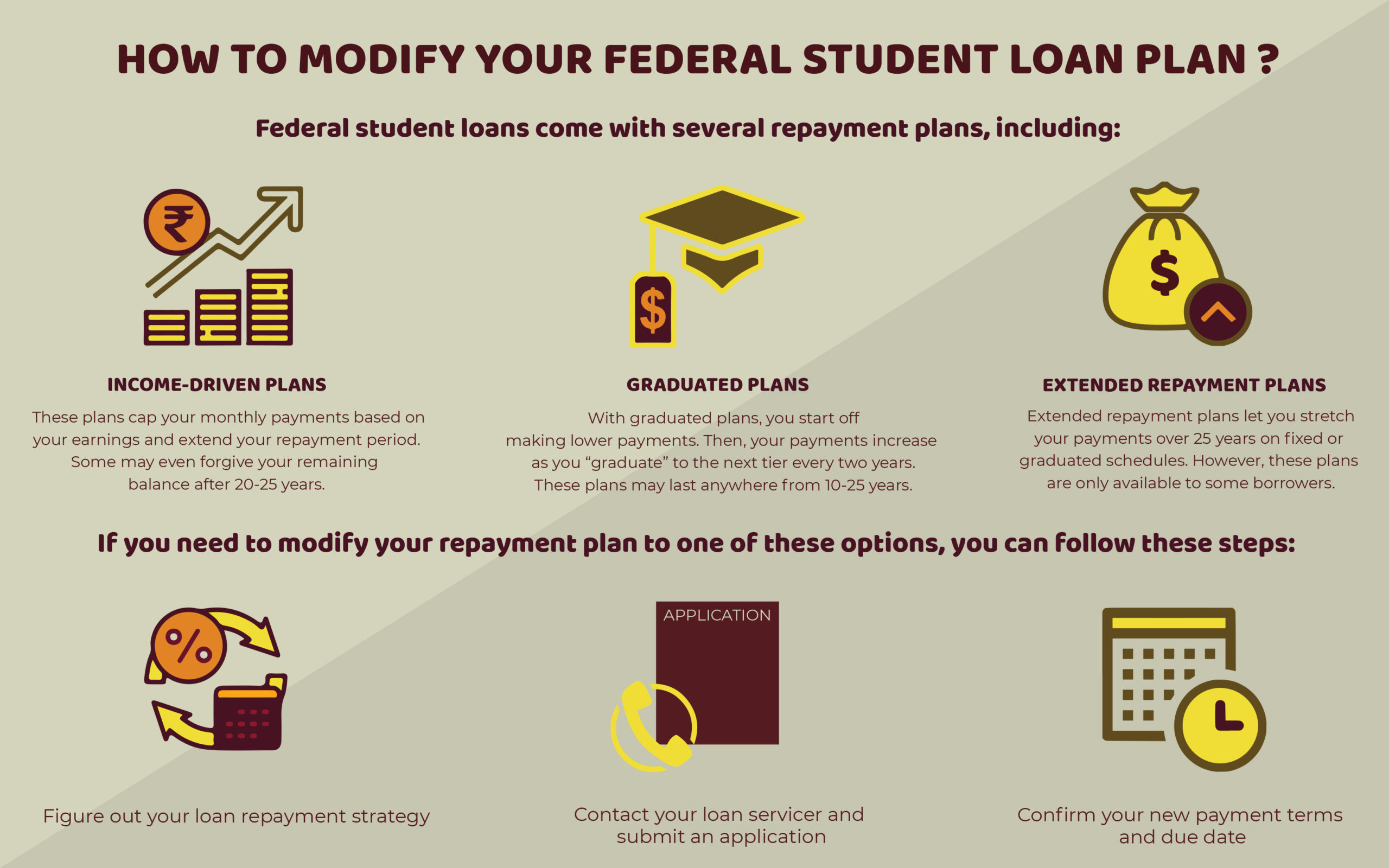

How to Modify Your Federal Student Loan Plan

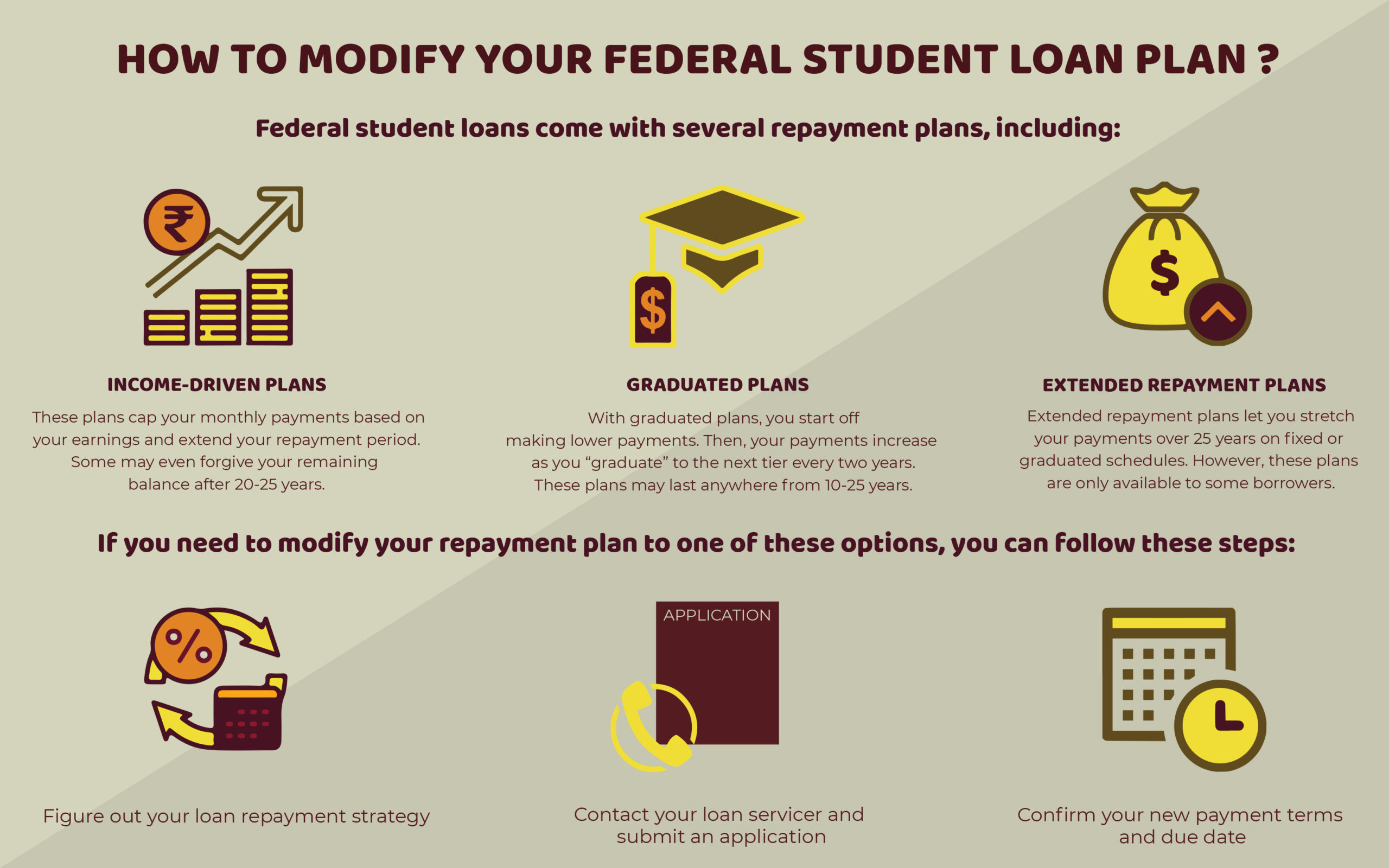

Federal student loans come with several repayment plans, including:

- Income-driven plans. The government offers four income-driven plans. These plans cap your monthly payments based on your earnings and extend your repayment period. Some may even forgive your remaining balance after 20-25 years.

- Graduated plans. With graduated plans, you start off making lower payments. Then, your payments increase as you “graduate” to the next tier every two years. These plans may last anywhere from 10-25 years.

- Extended plans. Extended repayment plans let you stretch your payments over 25 years on fixed or graduated schedules. However, these plans are only available to some borrowers.

If you need to modify your repayment plan to one of these options, you can follow these steps:

- Figure out your loan repayment strategy

- Contact your loan servicer and submit an application

- Confirm your new payment terms and due date

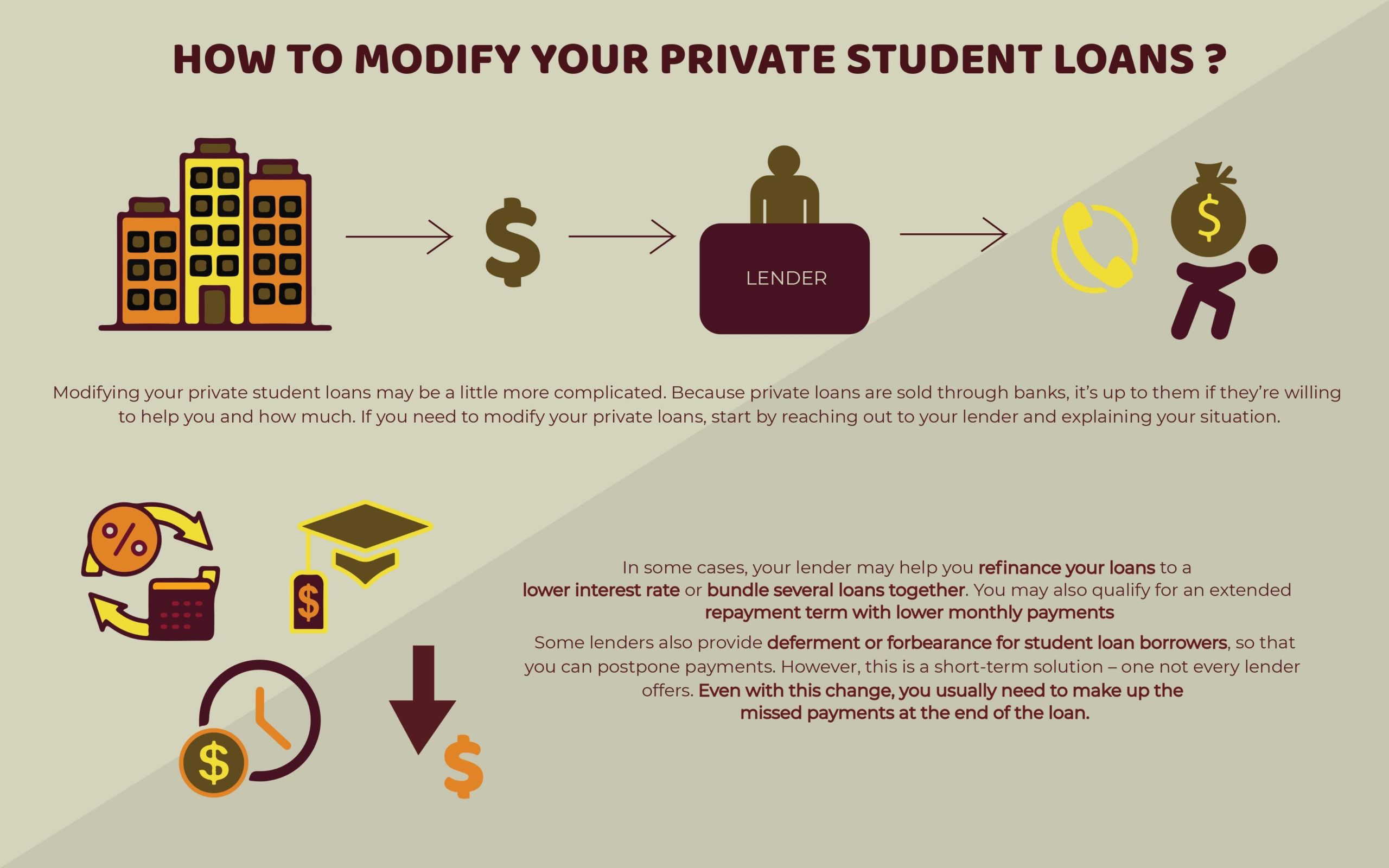

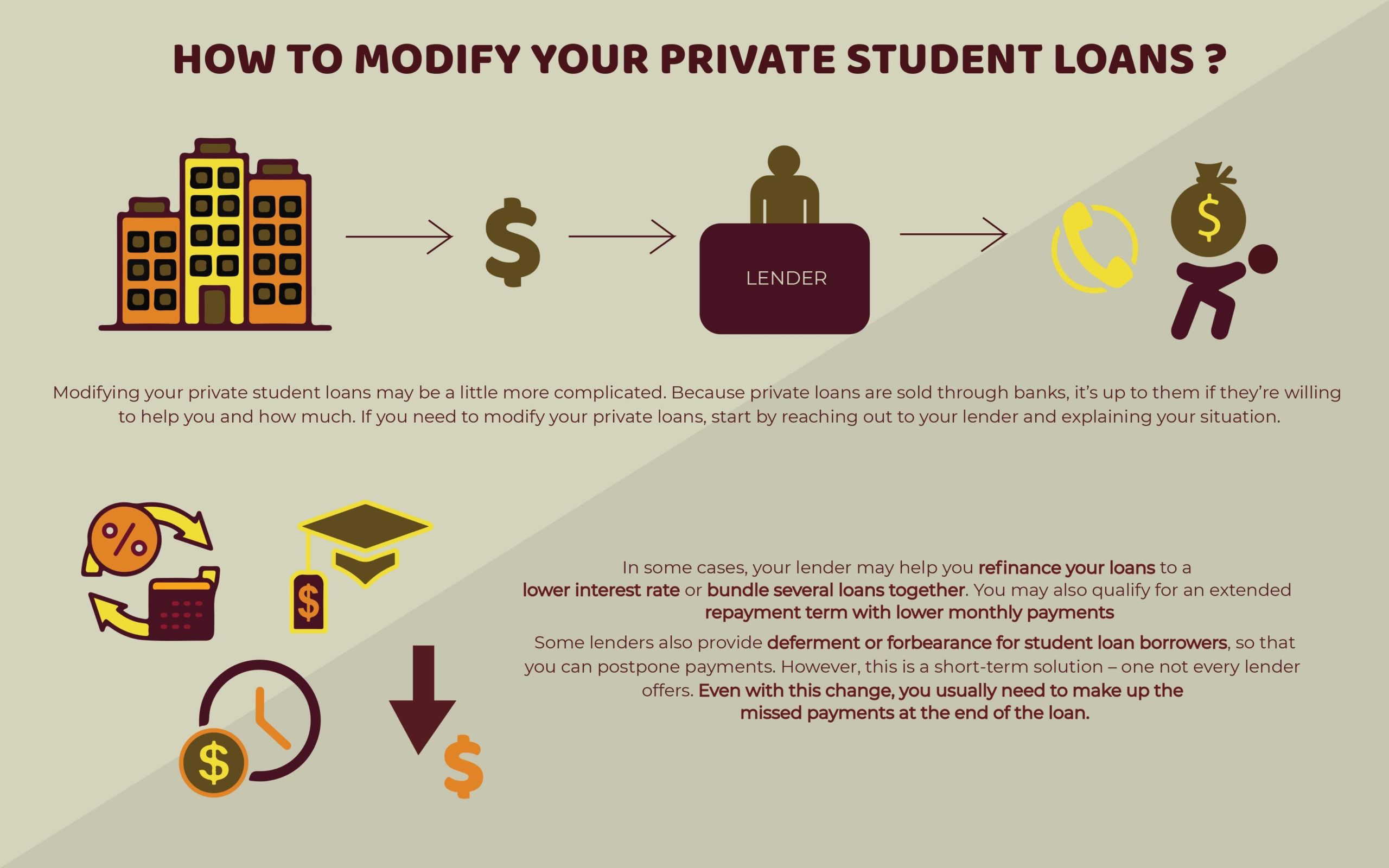

How to Modify Your Private Student Loans

Modifying your private student loans may be a little more complicated. Because private loans are sold through banks, it’s up to them if they’re willing to help you and how much. If you need to modify your private loans, start by reaching out to your lender and explaining your situation.

In some cases, your lender may help you refinance your loans to a lower interest rate or bundle several loans together. You may also qualify for an extended repayment term with lower monthly payments.

Some lenders also provide deferment or forbearance for student loan borrowers, so that you can postpone payments. However, this is a short-term solution – one not every lender offers. Even with this change, you usually need to make up the missed payments at the end of the loan.

The Earlier You Start, the Better!

Typically, both federal and private lenders want to help you maximize repayment. If this means changing some of the terms of the loan, like lowering the payments or extending the length of the loan, they may try to work with you. But if they don’t know you’re struggling, there’s nothing that can be done. The earlier you reach out to modify your payment plan, the better off you’ll be.

Loan modification can apply to student loans and mortgages, even as you’re considering the bankruptcy process. If you’re not sure how to get started, our loan modification lawyers can help you from start to finish, getting your finances back on track.

Connect with Us